DeFi Options Overview Part 2: GammaSwap

The OG's of Impermanent Gain and volatility trading

Impermanent Gain: A DeFi Market Maker’s Dream

There’s a huge problem in crypto that not many people are talking about, and it’s really hindering the growth of DeFi. The problem is that market makers in DeFi are being ripped off, and without liquidity, you don’t have functional markets. So, logically, you want to incentivize liquidity providers (the market makers of DeFi). Lucky for us, there are some solutions being developed by some fellows with absurdly large brains.

DeFi is unlike TradFi in many areas, but one of the biggest divergences shows up in the realm of the “market maker.” Whereas in TradFi, market making is left up to dedicated (sketchy) institutions who operate in the shadows – and yes, this includes CEXs – DeFi allows anyone to deposit liquidity into DEXs and accumulate trading fees. We call these fine DeFi market maker folk “LPers” or “LPs,” which is short for liquidity providers. Another difference, of course, is that the actions of DeFi LPers are fully transparent on the blockchain (imagine being able to see Ken Griffin rugging bottom shorters in real time!).

The problem is, in the current state of DeFi, there’s not enough incentive for most people to want to market-make. That means there’s an inherent liquidity shortage in DeFi. During the doldrums of the bear market, this isn’t apparent, but it surely will show as demand picks up. If we’re going to build a decentralized financial market, it needs ample liquidity in all facets (spot, perps, options, nfts, etc.) at all times.

Theoretically, market makers should make the most money during periods of volatility. Overall, more volatility = more trading activity = more trading fees = more profits for LPs. However, one significant enemy continues to plague LPs. If you’ve been paying attention to DeFi for any of the past 2+ years, you know that enemy well. Say it with me: IMPERMANENT LOSS.

Also known as IL, impermanent loss is rampant in the current iteration of DEXs (concentrated liquidity market makers, or CLMMs), which was spearheaded by Uniswap V3. Basically, LPs deposit a “portfolio” of 2 assets with equal 50/50 weightings into CLMMs. As the prices of those 2 assets move, the “portfolio” is constantly rebalanced to maintain that 50/50 weighting. In the process of that rebalancing, the LP is automatically forced to sell the asset that goes up in price and buy the one that goes down (or just underperforms on a relative basis). As you can imagine, this means they miss out on potential profits that they could’ve made if they had just held the two assets in their wallet.

To see the effects of this with a simple IL calculator, check out this resource from Daily DeFi. Using an example, say ETH is trading at $1600 and USDC is trading at $1, and you deposit $500 of ETH and $500 of USDC into UniV3. As the time passes by, USDC stays at $1 (as expected), but ETH miraculously doubles to $3200. Had you simply held each one (not on a CEX, of course), you’d have $1500 – $500 USDC and $1000 ETH, or a total return of 50%. But if you plug that example into the calculator linked above, you’d see that LPing in this situation only results in a return of 41.4%. Sure, you earn trading fees in the meantime, but history shows that a fair chunk of the time, those fees don’t make up for all the impermanent loss suffered.

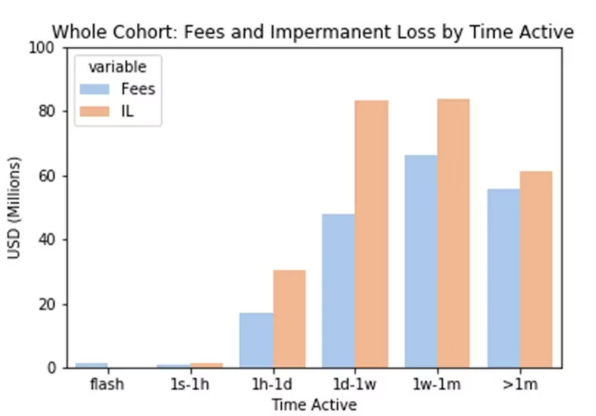

That chart really speaks for itself, and it says “IL bigger than fees – no bueno for LPs.”

So, what’s the point of this whole rant on IL? Doesn’t everyone already know this? Maybe if you’re in a bubble. But what people may not know is the inner workings of sheet brilliance being worked on by a DeFi protocol called GammaSwap.

As you’ll see, GammaSwap is working to cure the IL disease, putting more money in the pockets of LPs, which in turn should attract more LPs and bolster the entire liquidity pool of DeFi. The cure? Volatility derivatives. Using these derivatives, LPs will be able to hedge against IL and actually earn impermanent GAIN! My, how the tables do turn.

The way that these derivatives are constructed is actually related to options, which is why I’ve decided to include them in my options series. After all, options are priced based on volatility. But anyway, enough rambling – let’s kick things off with an overview of GammaSwap.

Enter GammaSwap

When it comes to IG, GammaSwap is the OG. Indeed, the GammaSwap team coined the term “impermanent gain.”

GammaSwap, unsurprisingly, is built around the concept of gamma. This is an options-related term (one of the famous “greeks”), but stay with me here. Gamma is the expected rate of change of delta, which is how much an option’s price changes when the underlying asset changes. Say you have call options on ETH (ETH = “the underlying” in this example) with a delta of 0.4. For every $1 ETH goes up, your calls are expected to go up $0.40. But as ETH goes higher, so does the delta. The gamma is just the speed at which the delta goes higher.

Another way to think about gamma is that it basically represents the volatility of an option. Short gamma is short volatility, and long gamma is long volatility. When you’re short gamma, you want the underlying asset to stay flat (or “crab,” as us sophisticated DeFi lads and lasses would say). When you’re long gamma, you want the underlying to move in a big way – it doesn’t matter which way, any big move is good.

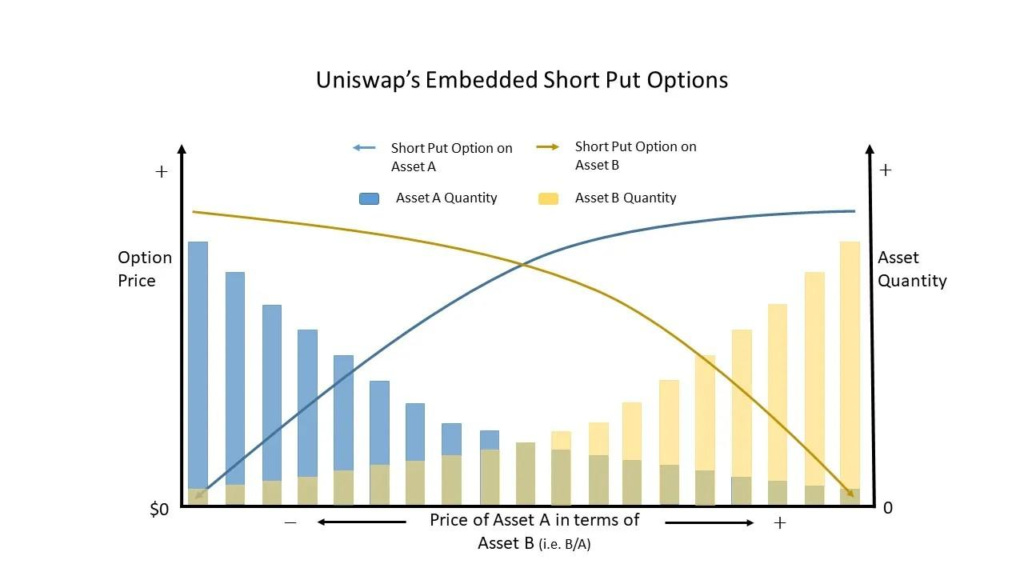

Ok, now to tie it all together. In CLMMs such as UniV3, LP positions are basically short volatility, or short gamma. In fact, the payoff of an LP resembles that of a short put option (I went into detail about this in my last options article if you need a refresher).

Impermanent loss happens when there’s volatility in the markets, so to hedge against it, you have to go long gamma. Therefore, the impermanent gain must replicate a long gamma (long volatility) position.

Lending and Borrowing on GammaSwap

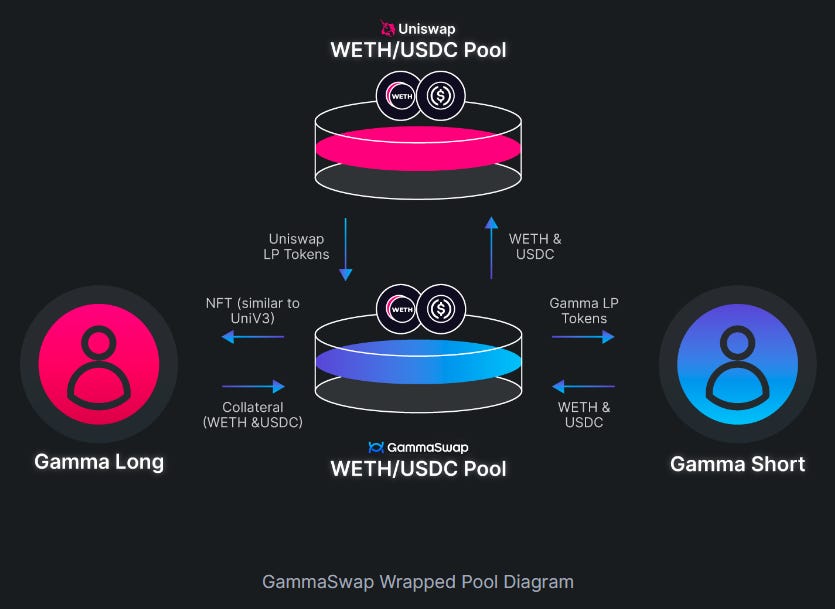

So, how does one create a long gamma position in DeFi? This is where the magic of GammaSwap comes into play. On GammaSwap, there are two primary positions that users can take: lenders (gamma short) and borrowers (gamma long). Below is a summary of each (but first, a picture):

The Lender (short volatility):

A lender’s position is basically an LP position deposited into GammaSwap, and from there, deposited into a DEX. So, it’s basically the same as LPing on a DEX, but with a distinct extra benefit. On top of the DEX trading fees that they’d usually earn (net of IL, of course), lenders also earn extra fees from GammaSwap borrowers (those who are short volatility).

The Borrower (long volatility):

Borrowers use the liquidity deposited by lenders to create a special long-gamma position that earns the IL from lenders, paying a premium for the privilege. They do so by pulling the LP tokens out of the underlying DEX, at which point they become GSLP (GammaSwap LP) reserve tokens that represent/track the underlying LP token. The reserve tokens are worth more than the value of the LP token as the price changes because of IL, and that difference in price is the return of the borrower.

This concept can be a little convoluted, so let’s go through an example – we’ll use an ETH/USDC LP. Say you put in $100 of each token – $100 in ETH and 100 USDC. That means the LP token has a total value of $200 to start.

The lender deposits the LP token, worth $200, into GammaSwap. The borrower wants to take the opposite side of the transaction: hedging against IL, or in other words earning IG. We’ll imagine that the borrower pays a premium of $14.33 for the position. That money goes to the lender, which is a nice added source of income on top of trading fees (net of IL, of course!). Overall, the borrower now has a total position worth $214.33.

Side note: this example is taken from a great interview with Stephen TCG (one of the best in the biz) and the GammaSwap team exploring some nuances of the math that drives the protocol.

Now, let’s say ETH goes down by 18%, and as a result the LP token’s value falls to $180.97. In other words, impermanent loss has resulted in a >10% decay in the LP token. The lender’s loss is the borrower’s gain, however, as the value of the hedge subsequently goes up to $17.82 – a gain of 24.4%. Why did the hedge go up? Simply put, because the lender suffered IL. That in turn created a profit for the borrower. Remember, impermanent gain is just inverse impermanent loss.

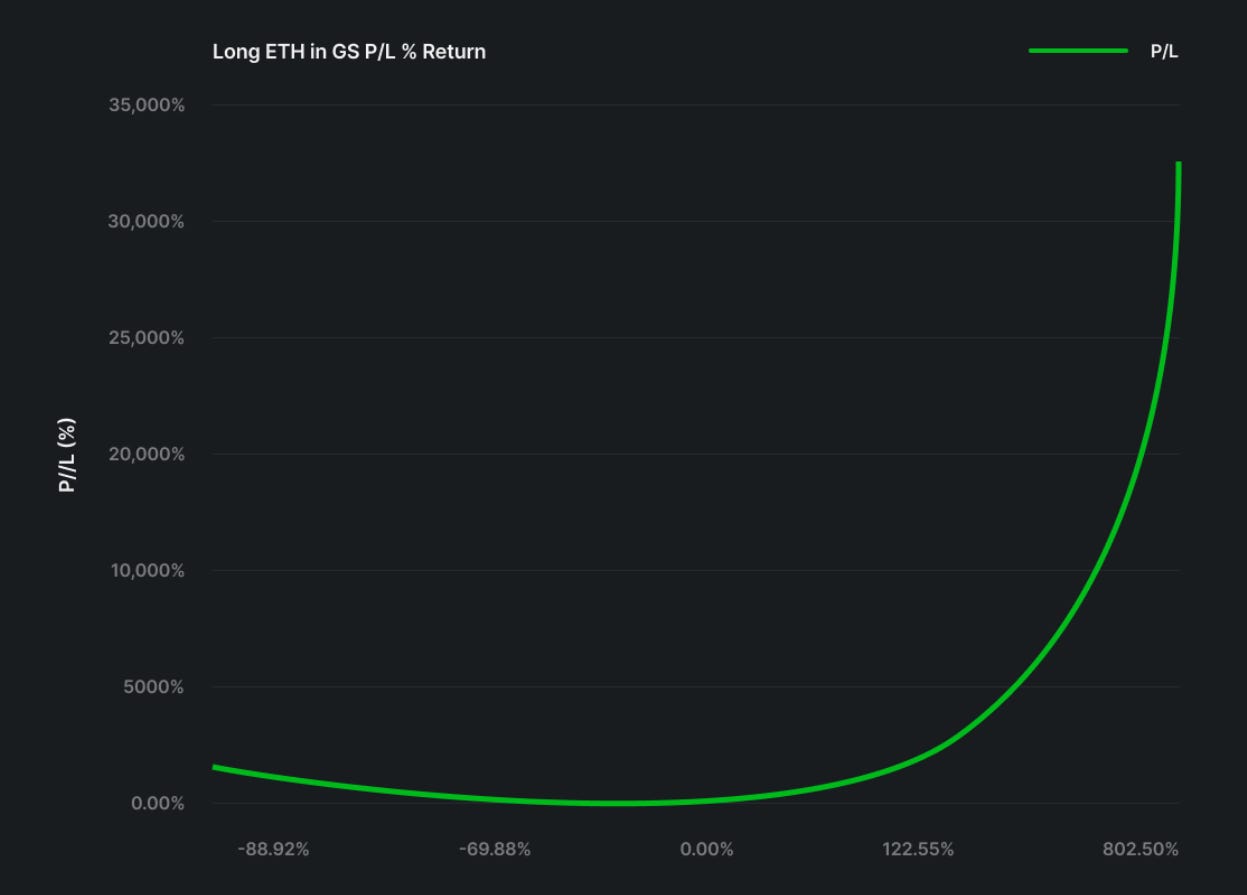

In this example, the borrower profited from the IL incurred due to ETH’s plunge. However, if the opposite had happened and ETH had mooned, the borrower would’ve reaped the same benefit. On top of that, the payoff function of impermanent gain isn’t just an inverse of impermanent loss – it’s also inherently leveraged.

Trading Gamma with Long and Short Bias

Now, there’s another crucial detail about borrowing on GammaSwap (and this is where the leverage comes into play). So far, we’ve described a scenario where you’d profit by about the same amount no matter whether volatility goes up or down.

However, if you happen to have some conviction (you know, that “gut feeling”) that the market is headed in a certain direction, you can alter the ratio of your borrowed LP assets to get a long or short biased position. This alters the payoff profile of the position as well. For simplicity’s sake, we’ll keep the ETH/USDC LP example.

For long positions, the borrower would be exposed more to the price of ETH; the ratio would be adjusted to about 60% ETH and 40% USDC. This way, the trader makes mega profits if ETH goes full-bull mode, and it still makes a profit if ETH goes down:

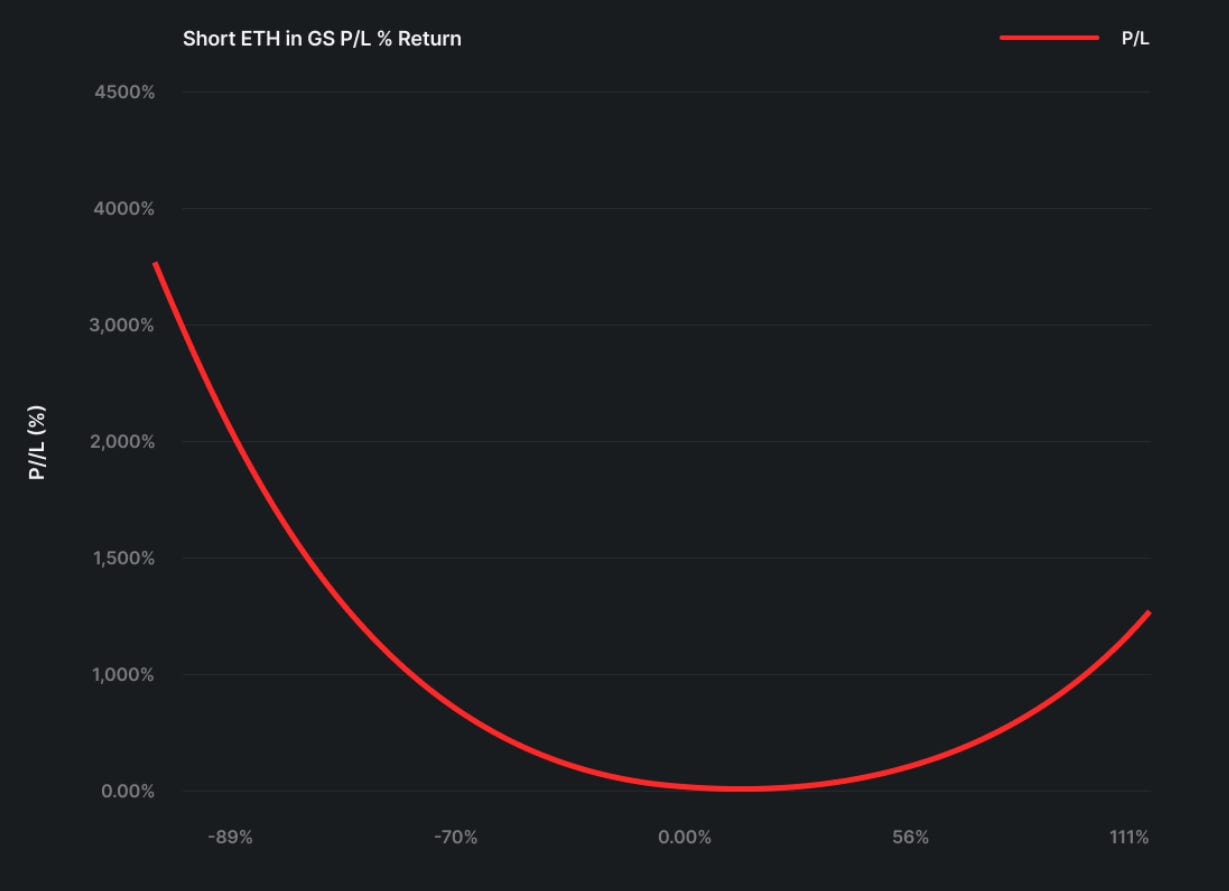

As for shorters, their LP position is readjusted to give – you guessed it – less ETH. Overall, it would come out to roughly 60% USDC and 40% ETH. The short-biased position is less volatile overall, but still can generate huge returns if there’s a big move in the market. Of course, it won’t capture as much of the upside, but if the market tanks, it has a fantastic payoff profile for a hedge (and still, over 1000% gain if ETH doubles isn’t bad!):

The bottom line is: all borrowers on GammaSwap can make money if there’s volatility in the markets in either direction. Not only that, but the returns are convex, meaning that your leverage actually increases as you make more of a profit, which results in making more profit over the same amount of time. Gamma, after all, is a convex measurement!

If anyone is interested in even more details on this concept, I’d direct you to that interview I mentioned with Stephen TCG – lots of great info!

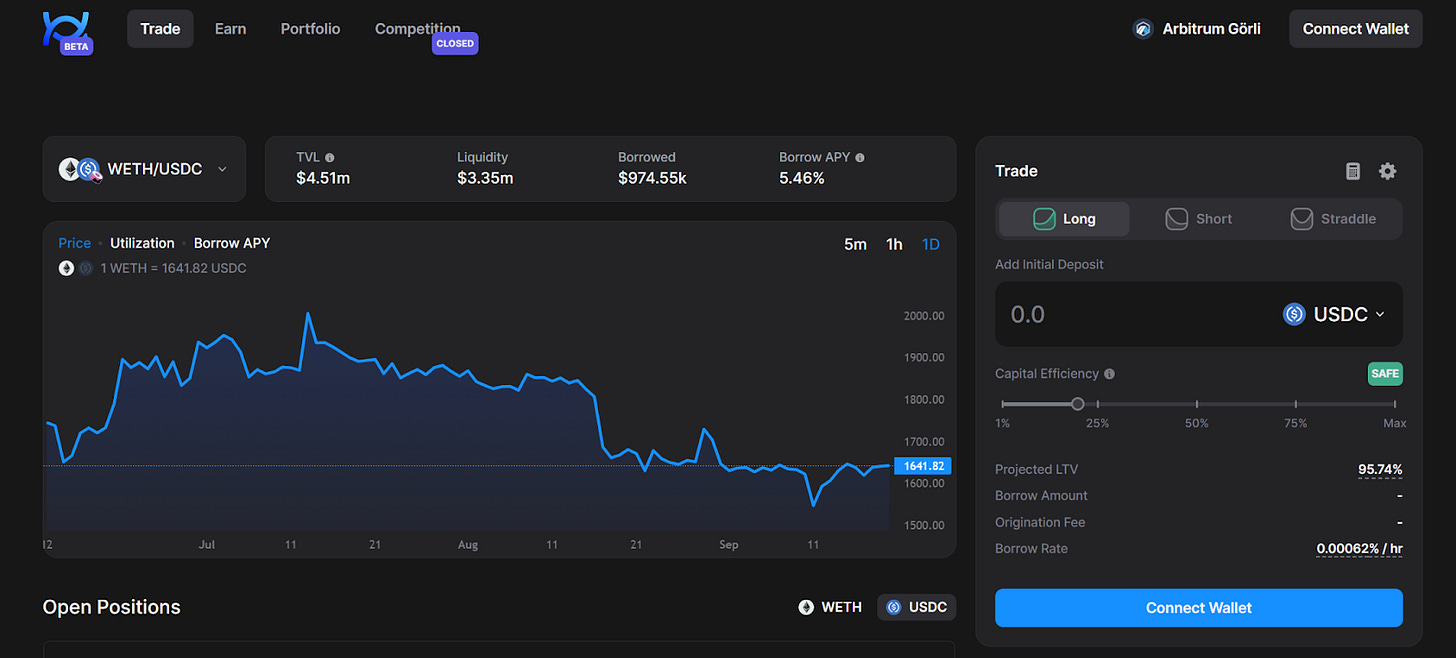

Now, let’s take a look at GammaSwap’s nice and clean new trading UI:

You’ve got your LP token selection in the top left, a nice big price chart below it, and you can select long, short, or straddle (straddle simply means you earn similar profits if there’s a big move in either direction) on the right hand side of the screen.

You also probably noticed the “capital efficiency” part below the deposit box. The higher the capital efficiency, the higher the “projected LTV” percentage, which is listed right below capital efficiency. Without getting too deep into the weeds, let’s dive (or wade) into what these numbers mean.

Getting Liquidated on GammaSwap

The higher the capital efficiency, the higher the LTV ratio. The LTV tells you how much of your position is taken out on margin. If you have a 97% LTV with a $1,000 position, it means that 3% ($30) of that position is taken out of your pocket, and the other 97% ($970) is being lent to you. If the LTV reaches 99.5%, your position gets liquidated and the remaining 0.5% is split between LPs and liquidation bots.

Despite the high margin amounts, it’s actually a little hard to get liquidated on GammaSwap. When most crypto traders hear the word “liquidation,” it dredges up PTSD of ETH moving 10% in 15 minutes and sending their trade to 0. But since we’re dealing with LPs here, it’s a little different.

The most important facet of liquidations when it comes to trading LP tokens is that they occur due to time, not price. For any fellow option traders out there, think about theta being the killer in this case. On GammaSwap, you go long gamma, which means you go long volatility. So, if there’s no volatility, that eats away at your position over time. More specifically, it eats away at that $30 portion of your $1000 trade until it reaches $5 (putting your LTV at 99.5%). When that happens, your position is liquidated. The main takeaway here is: the farther out you start from 99.5% LTV, the longer it’ll take for you to get liquidated.

The Utility of GammaSwap

Insane potential returns aside, there are some nice, practical uses for this product that nothing has been able to satisfy during DeFi’s short existence. So, let’s look at some ways that GammaSwap is set to improve the usability and capital efficiency of DeFi.

First and foremost, DeFi market makers (LPs) can finally sleep at night knowing there’s a way to hedge against the previously-unstoppable force of IL. With GammaSwap, they can simply hedge their LP positions by borrowing against them.

Second, GammaSwap can turn the nightmare of launching a token into a much more pleasant experience.

We all know that new tokens are insanely volatile as price discovery can be unpredictable and extremely messy. As a result, it’s hard to get people to want to LP those tokens – after all, volatility has always been bad for LPers. No market makers therefore means no liquidity, and that can exacerbate the entire problem, leading to bad capital efficiency and basically no demand for the protocol’s new token. In short: token launch, if mishandled, equals death.

Since GammaSwap provides a way to hedge against this market making dilemma, individuals/institutions will be much more open to providing liquidity, and the projects themselves won’t see their own LP tokens’ value wither away.

I could also see GammaSwap ending up being similar to GMX in that an entire ecosystem of projects will form around it. There are lots of ways to use borrowed LP positions to create different products.

For example, some brilliant dev out there could build a depeg insurance protocol powered by GammaSwap’s tech. Think about it: stablecoins and other pegged assets like LSTs are expected to have as little volatility as possible. In fact, stable pools are lauded for their lack of IL. So, if you’re long volatility, and something that’s supposed to maintain as little volatility as possible breaks free of its acceptable price range, there’s big bucks to be made for LP borrowers.

Of course, this can also be used to hedge. There are tons of new stablecoins popping up everywhere, and a lot of them have really attractive yields for LPers. A lot of people probably want to earn the yield but are skeptical that a new and unproven stablecoin will hold its peg. Solution: buy the stablecoin, earn the yield, AND borrow the LP on GammaSwap to hedge!

Finally, we do know that GammaSwap currently has a partnership with GMX. The synergy here is clear: creating a wide array of strategies using perps and options. For example, you could combine a long futures position on GMX with a straddle on GammaSwap. This would result in a synthetic hedged call position that can still make money if the price of the underlying falls by a significant amount.

A Glimpse to GammaSwap’s Future

All sorts of expansion is also on the horizon for GammaSwap. Their V1 protocol was built to function on UniV2 and similar constant function DEXs. In the future, GammaSwap V2 will shift to concentrated liquidity AMMs (CLMMs) such as UniV3 and CamelotV3 and use fully-composable LP tokens.

Most importantly, GammaSwap just launched their V1 app (literally the day I’m writing this). This is a huge step for DeFi in general, as they’re the first platform to officially offer impermanent gain positions.

Even in the early days, GammaSwap had other-worldly success – for example, over 15k users tested the platform in its first testnet month with no incentives. And better yet, the performance matched the hype; there was lots of positive feedback, and the users helped mold what would soon become the officially live GammaSwap app. More recently, the team watched in awe as over 4800 participants took part in GammaSwap’s trading competition back in June.

And if you’re hyped about their Arbitrum launch, just wait until you see what they’ve got in store with their tokenomics:

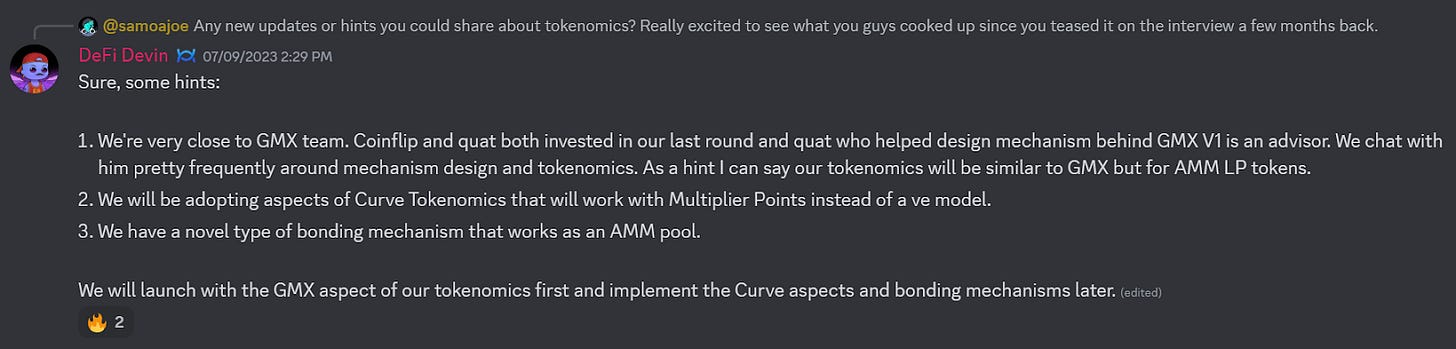

Personally, my expectations are high: perhaps a tokenomics model as innovative and unique as GammaSwap itself! In case you missed it, some crumbs were dropped in the Discord channel a couple months back:

Initially, GammaSwap will call Arbitrum its home, as this is where the most partnership-hungry projects seem to be for now. However, the team also plans to launch on mainnet where there are way more tokens, more liquidity, and potentially depressed IVs. In the longer-term, we may even see GammaSwap expanding to other EVM chains.

To sum it all up, GammaSwap will enable completely new features in DeFi. While there’s some hype around the project by traders, fellow options nerds, and people who have been following it for a while, I think the vast majority of DeFi users are actually overlooking this launch. I’d even argue that it’s more revolutionary than GMX, as it offers something you can’t get on CEXs or anywhere else in DeFi (for now, at least!). It also will make LPing a much more pleasant experience, as LPers who use GammaSwap can earn higher APYs than if they simply used the underlying DEX, and LPers on other DEXs can hedge their positions. A year from now, it will be very interesting to see how GammaSwap has impacted the broader DeFi space.