DeFi has several innovations that build on the massive system TradFi has created. These innovations won’t go unnoticed for long, as they pose major improvements to liquidity, capital efficiency, and UI/UX, and it’s only getting better.

Today, we’re going to dive into a couple very interesting options protocols that are pushing the cutting-edge innovation of DeFi forward.

This article is probably going to be long enough as it is, so I’m not going to include a detailed background of what options are. But if you’re unfamiliar with options, I’d recommend looking at the “Options Trading 101” guide produced by Panoptic, which you can find here.

Now that that’s out of the way, you should know that the two projects I’m summarizing today take traditional options and make them almost unidentifiable from traditional options – so, those resources probably won’t help you much today!

That’s because these projects are in the business of perpetual options. Basically, they create options using DeFi-native liquidity. And to do that, you have to significantly alter the characteristics of what we know as options. So, without further ado, we’ll have a look into Panoptic first and then dive into Predy Finance before we wrap things up.

Option Perps #1: Panoptic

Panoptic aims to solve the problem of liquidity fragmentation, specifically pooling liquidity in order to create a sustainable on-chain options market with what they call XPOs: expirationless perpetual options.

XPOs vs Perpetual Futures

With XPOs, we have the same benefits that perpetual futures brought to traders. Perpetual derivatives in general are great because they eliminate the need to roll positions before they expire. This removes the bunching of trades that happen before each expiration date and can manufacture unnecessary volatility, which improves liquidity conditions in general.

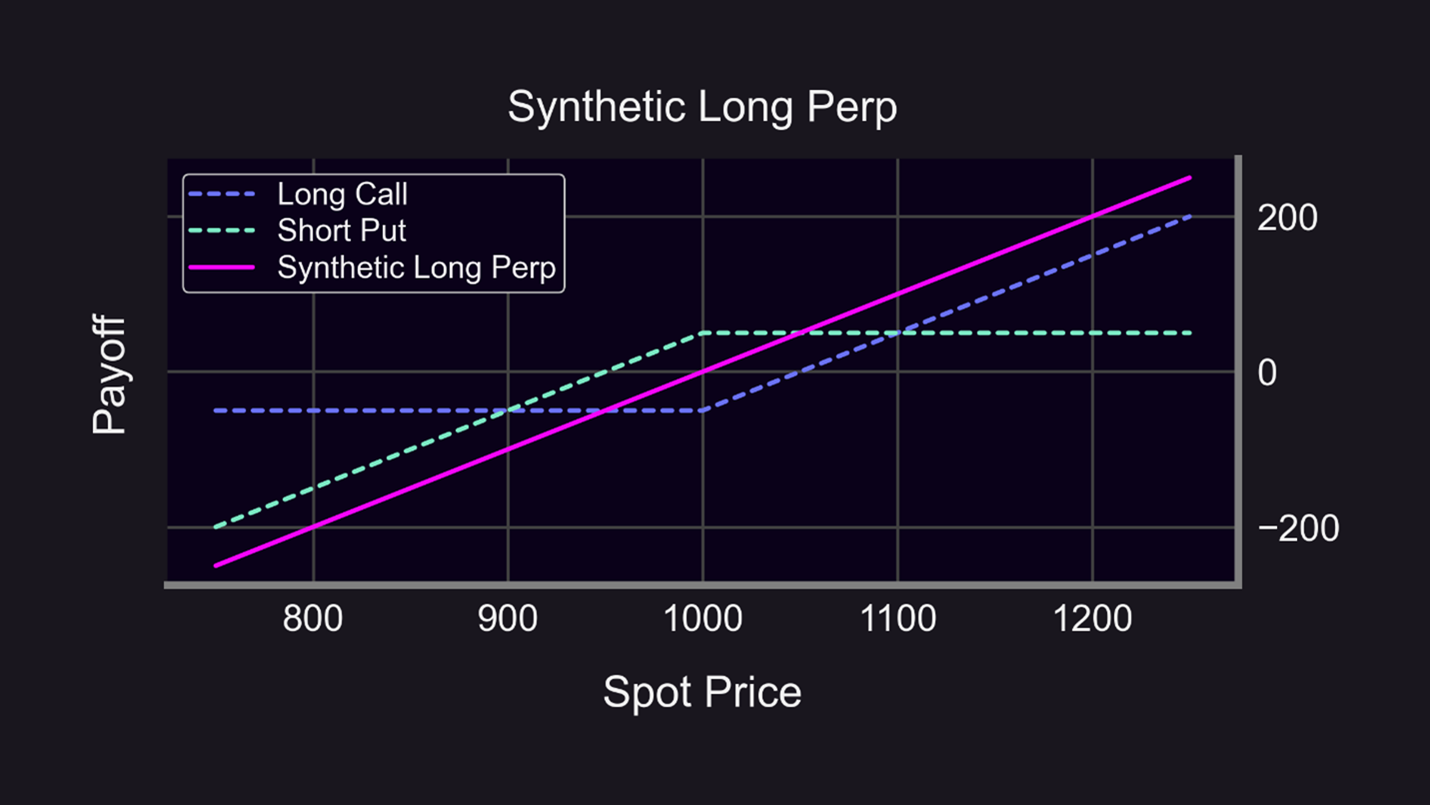

But there’s also a key difference between perpetual futures and perpetual options: perpetual futures allow traders to go long and short. But XPOs contain the same advantage that traditional options bring to TradFi: you can structure a trade to carry out a wide variety of different payout profiles. You can even create synthetic perp futures positions with options; for example, you can combine a long call and short put position to emulate a long futures position:

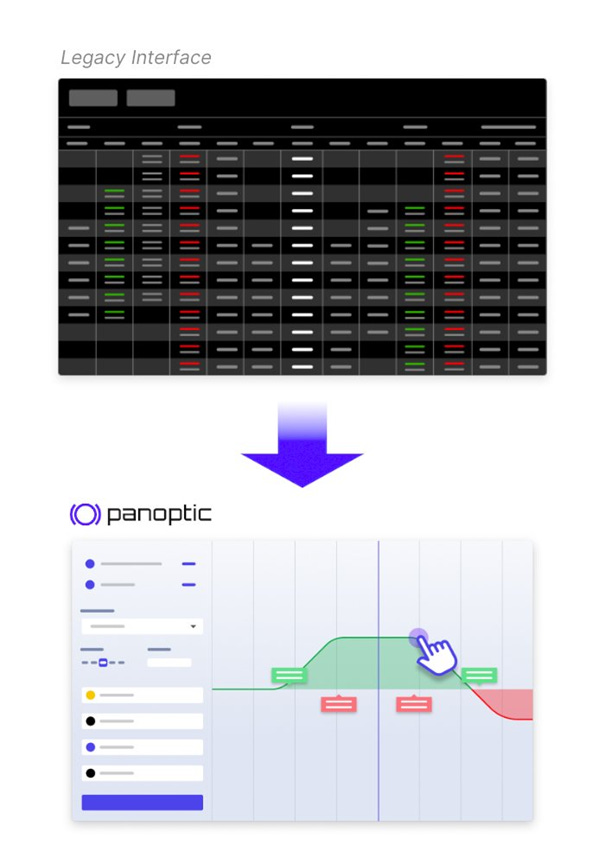

Another difference is that futures in general are way more straightforward to use than options. But as we’ll see, Panoptic is changing the way we look at options (literally) – instead of having complex option chains, users will choose a strategy based off a simple layout of its payoff profile, like this:

XPOs vs Traditional Options

Now, let’s look at some of the key differences between XPOs and traditional options. Since “perpetual” is literally in the name, you’ve probably already figured out that these options don’t expire. This eliminates a key trait of traditional options: the expiry date. The implication of this is that options can now be held for an indefinite amount of time. That also puts another key characteristic of options into question: exercising.

In TradFi, you either have American or European options (in most cases). Both of these types of options can be exercised at the expiration date (and American options can be exercised at any point beforehand as well). So, if you don’t have an expiration date, what happens to exercising?

On Panoptic, the action of exercising your position is unorthodox, but effective. To understand how this works, it’s helpful to keep the following in mind:

In order to buy options on Panoptic, someone first needs to sell them. So in theory, a buyer could hold onto their long option forever, but that would mean the seller is forced to do so as well.

However, that’s not exactly fair – so the seller can force the buyer to “exercise,” or close out, their position. Additionally, the buyer can “exercise” their position at any point in time (equivalent to an American option in traditional option markets).

As we’ll see later, the seller pays the buyer in return for forcing them to exercise their options.

How XPOs Work

Since Panoptic’s goal is to de-fragment liquidity to create a viable market for options, it would make sense to use liquidity that’s already concentrated in a certain area. And since we’re talking about on-chain creation and exchange of options, common sense would point us in the direction of DEXs, the biggest of which is Uniswap with over $3B in TVL. More specifically, Panoptic uses UniV3 (which still has a ton of liquidity).

However, Panoptic isn’t using a DEX the way you’d expect. Instead of using the AMM or CLOB model or some combination of the two to support option trading, they’re going a completely different route: using Uniswap V3 LP positions to facilitate option trading.

Before we get into the details of that, there are many reasons that building on top of UniV3 is a smart move. Here are a few:

First, UniV3 pricing is very efficient because of its deep liquidity – that means options on Panoptic will inherit minimal slippage and efficient pricing.

Second, that efficient pricing means that things like liquidations and forced exercise aren’t easily manipulated.

Third, UniV3 earns a ton of fees, which flow through to Panoptic users.

Fourth, UniV3 is notoriously safe, and since a portion of Panoptic’s liquidity is deposited into UniV3, it inherits that feature as well.

How UniV3 Positions are Option-Like

Yes, you read that right – it turns out that moving liquidity to and from UniV3 creates similar payoff profiles to options. But how is that even possible, you ask?

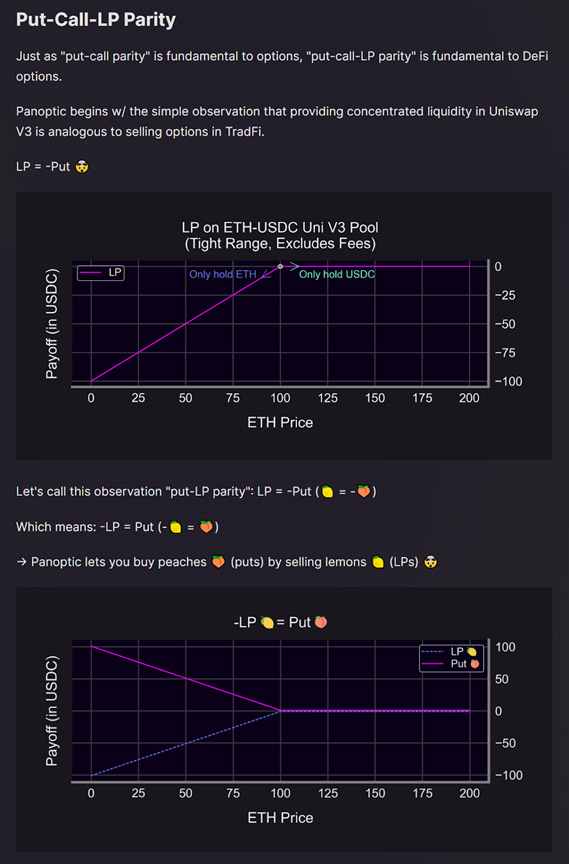

If you’re familiar with options, you’ll know that buying a put is essentially betting on the price of an asset to go down. So, selling a put means you’re betting that price will stay flat or go up. Let’s use the ETH/USDC pair as an example.

When you deposit the ETH/USDC pair into UniV3, the auto-rebalancing gives you more USDC when ETH goes up, and more ETH when USDC goes up (relatively) – in other words, you buy the dip in the asset that’s relatively dipping.

Therefore, depositing ETH/USDC is like selling a USDC-denominated put on ETH – if ETH stays flat or goes up, you profit in USDC. On Panoptic, to sell a put, you deposit USDC and get the payoff of the ETH/USDC pair. This process is well-illustrated here:

Just as buying a call is betting on the underlying asset to go up, selling a call is betting on the underlying asset staying flat or going down.

So, the reverse is true for selling calls: depositing ETH/USDC is like selling an ETH-denominated call on USDC. You’re really betting that the relative value of USDC stays flat or goes down, in which case your ETH-denominated balance will grow.

If you want to dive deeper into this concept, a really really smart guy by the name of Guillaume Lambert explains it in great detail here.

Providing Liquidity on Panoptic

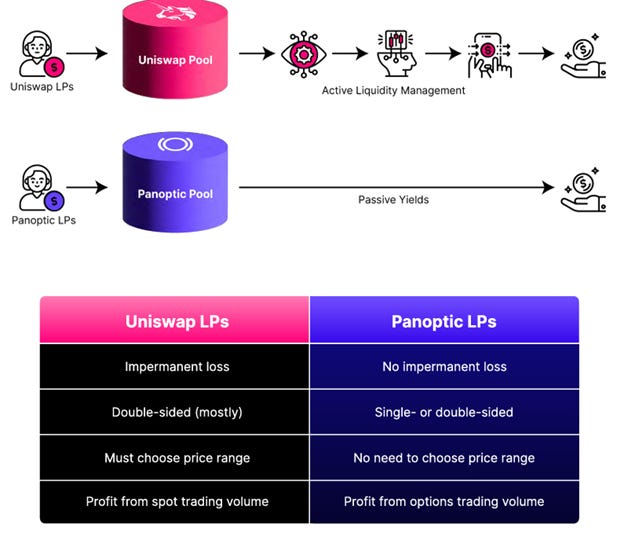

You can think of the liquidity on Panoptic as being a layer on top of UniV3. This liquidity is used to facilitate trading on Panoptic, and deposits/withdraws from UniV3 based on users’ orders.

To provide liquidity on Panoptic, you’d simply deposit a token pair at any ratio (it doesn’t need to be 50/50 like on UniV3). This liquidity is then moved to and from UniV3 based on buy and sell orders The incentive of doing this, of course, is earning fees:

Panoptic LPers (PLPs) receive fees in the form of commission on options traded. The amount of this fee hasn’t been set in stone, but the team is currently testing 0.1% commissions on the total notional value of options traded as the project is in beta. However, that may change going forward.

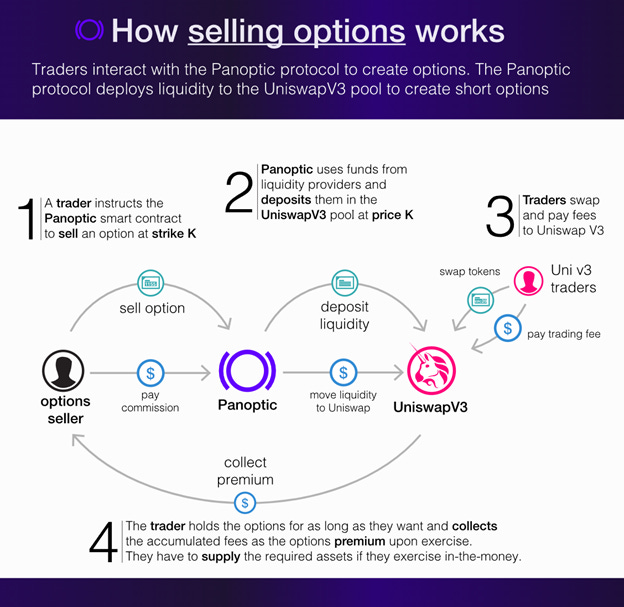

Buying and Selling on Panoptic: How it Works

We’ll go over selling first, since we now (hopefully) understand how UniV3 LP positions represent short option positions. When someone enters a short position on Panoptic, they essentially borrow liquidity from the protocol, which then deposits it into UniV3.

If we take this notion a step further, this is where the strike price enters into the equation.

Going back to the ETH/USDC example, let’s use the following parameters:

· ETH is currently trading at 1800 USDC.

· Sell ETH/USDC put at 1500 strike price at 5% width.

In this case, the following steps would occur:

User deposits 1500 USDC.

Panoptic deposits LP into UniV3 with a range of 1428-1575 (+/- 5%).

Now, we get into the “moneyness” of the option. For traditional put options, the option is “in the money (ITM)” when its strike price is above the underlying asset’s price. It’s “at the money (ATM)” when its strike price is equal or very close to the price of the underlying. And it’s “out of the money (OTM)” when its strike price is below the underlying asset’s price.

For these options, it’s a little different. In this case, we’re dealing with an OTM put option, as 1500 (strike) < 1800 (underlying). It’s also important to note that ATM in this case refers to the range at which liquidity is provided, which is between 1428-1575. Here’s how the position looks when it’s ITM, ATM, and OTM:

When the price of ETH is above 1575 (OTM), the position is 100% in USDC (buying the dip in USDC – good for put seller).

When the price of ETH is between 1428 and 1575 (ATM), the position is a combination of ETH and USDC, as well as earning fees as it’s in range.

When the price of ETH is below 1428 (ITM), the position is 100% in ETH (buying the dip in ETH – bad for put seller).

When the underlying asset is in range, the position earns UniV3 trading fees, which then get passed to the seller on Panoptic.

Now, let’s move onto the role of the buyer on Panoptic. First, the way that Panoptic works, there can’t be a buyer without a seller, which alludes to the absolute importance of market makers and consistent liquidity flowing into this protocol. But anyway, let’s look at the previous example from the perspective of the buyer.

You want to buy a put with 5% range on ETH/USDC with a strike price of 1500, and the price of ETH is currently 1800 (making this an OTM put option). The Panoptic protocol then makes sure there’s a seller to match your order with, and if there is, it removes the respective amount of the ETH/USDC UniV3 LP position.

In this case, you’d borrow the money taken out of the pool (1500 USDC), which was taken out of the 1428-1575 range we mentioned in our earlier example. Now, since you’re effectively short USDC, you benefit when the price of ETH/USDC goes down. As we saw earlier, when the price goes below 1428, the option is ITM, and the position is 100% in ETH – this is good for the long put position.

Buying and Selling on Panoptic: Fees and Leverage

The fees earned by options sellers on Panoptic are similar to the idea of a premium paid to the seller of a traditional option. However, there’s one big difference: traditional options pay the premium all upfront, while XPOs pay the premium over time. This brings us to Panoptic’s “streamium” payment method.

Now, just as depositing liquidity into Uniswap represents a sell order, withdrawing liquidity represents a buy order. There’s one problem: if the seller’s liquidity was just withdrawn, what happens to the fees that would’ve been earned by the option seller? Simple: the buyer pays the fees that would’ve been earned by the LP position to the seller.

This is where the streamium comes into play. The seller earns gradual income, either from Uniswap LP fees, or from their counterparty (option buyer).

Option buyers can also earn forced exercise fees from sellers. This is simply compensation for having their position closed against their will. The farther away the underlying asset’s price from the strike price, the cheaper the fee.

Now, let’s talk about “pool utilization” and how it affects leverage available to users. The pool utilization just refers to how much liquidity on Panoptic is currently sitting in UniV3.

If the PU is high, it means there are a lot of option sellers. If it goes above 90%, the protocol disincentivizes further selling by disabling leverage for new sellers.

If the PU is low, it means trading activity is probably low and LPers earn fewer fees in aggregate as there’s less liquidity deposited in UniV3. If it goes below 10%, and the collateralization ratio is 20% (meaning new sellers can use up to 5x leverage).

So, the activity of the protocol will incentivize balance between buyers and sellers by adjusting max leverage of 1x-5x for sellers. Option buyers, on the other hand, will have anywhere from 5x-10x leverage capability.

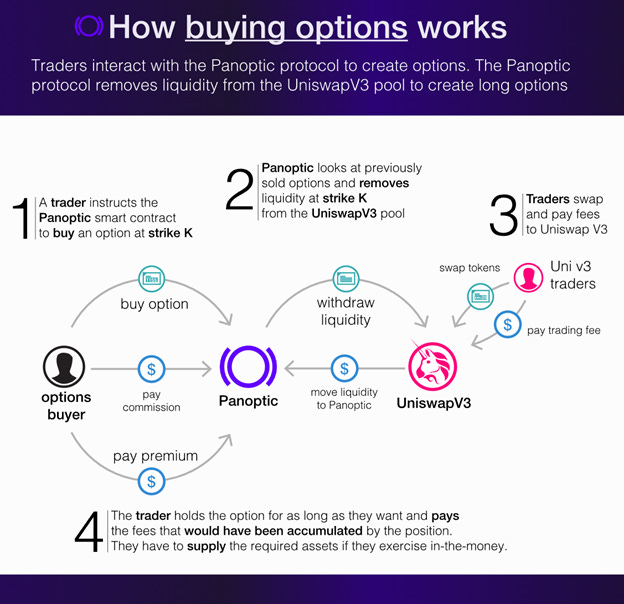

Future of Panoptic

In the immediate future, we can look forward to the long-awaited gated launch of Panoptic. To give you an idea of how anticipated this is, there were more than 4,000 users who signed up in as of July 28th, under a month after the whitelisting process started. Talk about a strong and eager community!

All we’re waiting for at this point is for OpenZeppelin’s audit of Panoptic to be complete. This should happen by the end of the month.

At first, only ~32 participants will be chosen for the first epoch’s (1 epoch = 1-3 weeks) trading competition, but this will quickly expand in all future epochs. Eventually, the goal is to allow all 4,000+ applicants to participate.

After that, we can expect the official mainnet launch sometime this fall, potentially in Q4. Here’s a broad view of the future, where you can see that the Panoptic team has quite a lot of going on!

We can certainly expect lots of expansion in Panoptic’s future. First, the team has already stated that they want to make their way onto L2 chains at some point (Arbitrum, per chance?).

But it doesn’t stop there, it’s only a matter of time before they also expand onto different DEXs; the protocol is actually able to integrate into any CLMM DEX, giving them many avenues for expansion via chain as well as liquidity source.

Overall, this is an extremely interesting (as well as complex) use case for DeFi liquidity, and I’m excited to see what sort of traction Panoptic is able to generate once it goes live!

Option Perps #2: Predy Finance

Next up, we have Predy Finance, which has somehow flown under the radar despite providing a similar service to what Panoptic is aiming to achieve. Since we already went over how UniV3 LP positions are similar to options in detail in the Panoptic section, this overview will skip explaining it once again as it builds on a similar concept. However, there’s still much to go over, and we’ll see how Predy has evolved over the past year amid 3 new protocol upgrades, as well as what they have in store for the future.

Predy V3

V3 was a massive breakthrough for Predy, bringing perpetual options onto the DeFi scene. By showing the relationship between UniV3 LP positions and traditional options, this product truly was a catalyst for the entire space.

As we discussed earlier, UniV3 LP positions have similar payoff profiles as short puts (as well as covered calls). The problem is: gamma (convexity) is way more expensive when bought through UniV3 LP positions than it is for traditional options. So, in Predy v3, users can use leverage by borrowing ETH using USDC as collateral. This article shows how Predy V3 actually allows users to get 7x the gamma using their leverage feature as they would by simply LPing on UniV3.

Predy V3 gave users the ability to go long and short puts and calls, as well as different combined strategies like strangles, which we’ll describe in more detail shortly. V3 achieved this in a similar way as Panoptic is looking to achieve on-chain options trading via concentrated liquidity LP positions, with a stronger focus on providing cheaper gamma via leverage. But as we’ll see, later iterations of the project make this function even more efficient.

Next came v3.2, which introduced Squart – a big step in revolutionizing DeFi options.

V3.2 and the Dawn of Squart

Squart is a novel derivative that basically represents a less volatile version of the underlying asset. As we’ll see, there are some huge benefits that go along with this feature.

You may be familiar with Opyn’s Squeeth product. Squeeth is basically “ETH squared,” and it tracks a squared version of ETH.

Squart is a similar concept, except it tracks the square root of the underlying instead of the squared version. So, say ETH doubles in price from $1,000 to $2,000. Squart would go from $31.62 to $44.72, resulting in a less volatile return of 41.4%. So, one clear benefit is that it reduces volatility for an asset.

Why Squart?

I know, I know, the degens out there are wondering, “why would anyone want a lower return??” Don’t worry, we’ll get to the leverage aspect of this soon.

But first, arguably the most important feature of Squart is the fact that it makes the market for perpetual options way more capital efficient.

In the pre-Squart era, liquidity in Predy’s perpetual options market was fragmented by strike price. As you can see here, the liquidity is spread out across multiple strike prices in the bottom right corner:

As we saw in the Panoptic overview, in order for there to be an option buyer in this model, someone first has to sell that option. But why would anyone want to sell an option with an out-of-range strike price? The simple answer is: they wouldn’t, because out-of-range LP positions don’t earn trading fees. This takes a toll on liquidity and concentrates it into a very narrow band of strike prices.

However, Squart’s key benefit is that it condenses all of this liquidity into one position (Squart), as you can see here:

Instead of having a range of available strike prices, Squart provides the synthetic form of a constantly at-the-money option, which means the strike price is very close to the spot price of ETH.

This maintains the payoff profile of options, while actually using perpetual Squart futures as the core asset that users are exposed to. By combining liquidity all into one place, this design makes for a much more efficient protocol.

Strangles using Squart

Now, let’s take a look at how you can trade volatility with Squart by going long or short strangle spreads.

First, what on earth is a strangle? Basically, it’s an option position consisting of a put trade and a call trade. More importantly, the put and call must both be at-the-money. Remember how Squart is basically a synthetic at-the-money option? It’s a perfect product to mimic the return profile of long and short strangles. Let’s see how these work:

A long strangle is going long an at-the-money put and an at-the-money call. This is a relatively expensive option trade, where you’re betting that volatility will increase on the underlying asset.

For example, say ETH is trading at $1800. A long strangle would consist of an $1800-strike call and an $1800-strike put (both long). Say these both cost $300, making your total cost $600. One of these positions is going to end up being worthless, so in order to make a profit, ETH must make a relatively big move in one direction. Thus, you’re betting on future volatility.

A short strangle consists of a short call option and a short put option, both at-the-money. The intent here is the exact opposite of a long strangle; instead of betting on future volatility, you’re betting that the price will stay range bound in the near future.

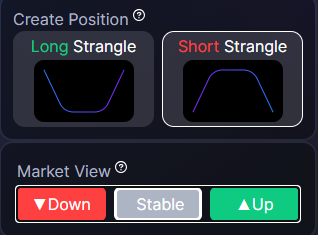

Now, what I’ve described so far represents a “neutral” strangle position, meaning that the strike price for both options is perfectly at-the-money. However, not all strangles are done this way. As such, Predy gives users the choice to adjust their positions based on their future expectations of the underlying asset’s price as well as its volatility. As you can see here, in addition to choosing a long or short strangle, you can also specify whether you want the trade to favor the asset going up or down, or remaining stable:

For both long and short strangles, if you select down, the trade will be adjusted so that your max profit occurs if the underlying asset (ETH/USDC for V3.2) moves down 2.5%. If you select up, you’ll max out your profit if ETH goes up 2.5%. This is a valuable feature, and shows that Squart can be dynamic as well while still avoiding strike prices.

So far, we’ve described strangles from the perspective of volatility. However, you can also look at them from the angle of going long or short gamma:

Long strangle = long gamma

Short strangle = short gamma

Now, remember how Predy V3 solved the gamma expense problem of using UniV3 LP positions as options? Squart’s ability to mimic strangle trades takes full advantage of this feature as well. Not only does the user have access to a novel, synthetic at-the-money option, they also have access to cheap gamma and the ability to go long/short volatility. This is equally useful for speculators and hedgers alike.

Predy’s Delta Neutral Strategy

Speaking of hedgers, Predy has a separate feature in their “Strategy” tab where you can add automatic delta neutrality to a short strangle position. This is basically the same short strangle position using Squart, but it adds an automatic hedge as well.

Without getting into too much detail, the delta of a stable (perfectly at-the-money) short strangle is basically neutral when you initiate the position. If you choose to open a short strangle with a stable market view, you’ll need to adjust your position or a separate hedge to keep your position delta-neutral. Otherwise, as the price of ETH drifts, your delta will become lopsided in either direction, depending on the movement of ETH.

Predy V3.2’s Strategy improves on the strangle positions listed above because it keeps the position hedged as the price of ETH moves. This rebalances the delta hedge when one of two factors have occurred: 48 hours have passed, or ETH has moved 7.5%.

This feature has been a huge success thus far for Predy, generating some very nice fees. As you can see here, the APYs are amazing, with ETH/USDC nearing 40%, ARB/USDC at 57%, and even the stable LUSD/USDC pool almost at double digits:

Now, let’s see how V5 has improved on these features, as well as added some new ones.

Predy V5

Moving to the present, we’re now at Predy V5, which introduces delta-neutral strangle positions using, you guessed it, Squart.

Just like in V3.2, Squart is used as a perpetual futures position that represents a synthetic at-the-money option. However, there are some important upgrades in V5 that bring Predy to the next level.

More Trading Pairs

First, there are more trading pairs available. In addition to ETH/USDC, Predy has added ARB/USDC, GYEN/USDC, and LUSD/USDC. All of these pairs have the same options as V3.2 – users can long or short strangles on any of them, and customize the trade based on their market view. ARB/USDC and LUSD/USDC have also been added to the list of trading pairs available for Predy’s delta-hedge strategy.

The LUSD/USDC pair is particularly interesting to me as it opens up a new type of trading; if you open a long strangle, you’re essentially betting on one of the two stables losing its peg, which can be seen as an insurance product. This shows the versatility of using UniV3 pairs as options – you can tie it into a wide variety of strategies that fit all sorts of market views.

In addition to these new pairs, V5 allows users to adjust their positions while they’re open. This is a nice upgrade from V3.2, where the only action available for open positions was to close them.

We’ll likely see many more trading pairs added to Predy down the road, as they can basically add any token pair on UniV3. But simply expanding beyond ETH/USDC in V5 is a big step forward.

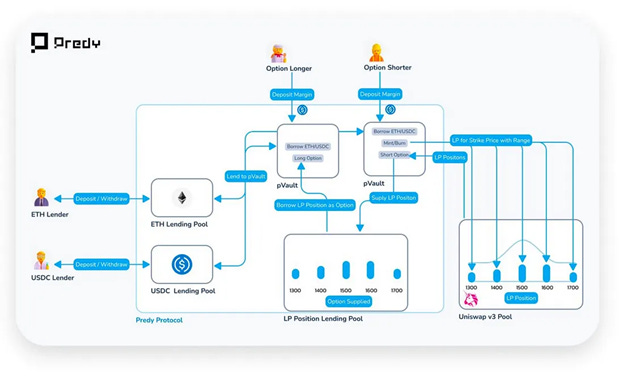

Lending Markets

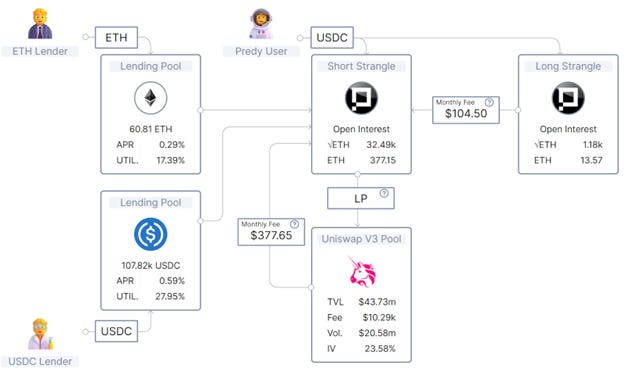

Personally, my favorite addition to Predy V5 is their new lending market. This functions very similarly to Aave, and users can lend/borrow ETH and USDC as shown below:

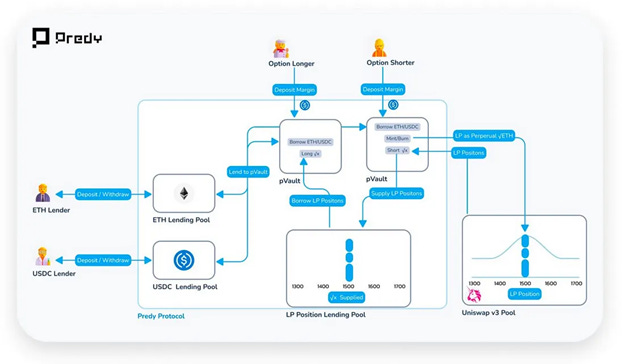

The creation of this lending market actually helps Predy to run much more efficiently and enable users to use leverage when creating their short strangle trades. As you can see below, the USDC and ETH lenders act as a source of liquidity for strangle traders:

When the assets deposited into the lending pools are used to open short strangle positions, those assets are then deposited into UniV3. The more users deposit into the lending pools, the more short strangles can be opened, which enables more long strangles to be opened as well. Soon, I would expect to see ARB, GYEN, and LUSD available to lend as well in order to facilitate liquidity for their respective short strangle positions.

Overall, both of these projects are contributing something useful to DeFi by building on top of currently-existing products. This is what I personally love to see, and it’s really just the beginning. There are many other projects out there building all sorts of other interesting option-based products, and I’ll be covering them as well in upcoming articles. I hope you enjoyed this overview of Panoptic and Predy!