Liquidity Management: A Major Catalyst for DeFi Growth

Judging by the $88 billion in collective TVL, I think we can say that DeFi has a somewhat solid foundation of users. However, this is still really scratching the surface. Next up is going to be a slew of crypto-native funds and organizations with plenty of money to put to work. And deep down, we all know that at some point we’re going to have to welcome TradFi into the ecosystem, too. The point is, the next stage of DeFi is going to involve large, market-moving players, and that’s a net benefit if you ask me!

But, there’s still lots of work to do before we’re ready. For example, LPing is a good sell for passive income strategies when you’re talking about receiving trading fees and sometimes even extra incentive rewards, but do you really think that any multi-billion-dollar organization is going to want to deal with impermanent loss? Not a chance. What about rebalancing in concentrated liquidity pools? Yea, no. In the traditional world, you have a team of people to do the grunt work like that for you. In DeFi, you have code do that for you, which is a big productivity booster. That’s the major advantage.

But you also need people to build the code to sort out these inefficiencies. Thankfully, the people building and shaping DeFi (and I’m not talking about the shills) is full of the people who left TradFi and big tech because they see the potential in the disruptor that is Decentralized Finance. And one of the things these geniuses are doing now is building strategies to manage liquidity for individuals and institutions alike, while minimizing the impact of IL and rebalancing fees. I hardly see anyone talking about this, but it’s a crucial part of the future of DeFi. So let’s talk about it!

For anyone who’s unfamiliar with the process of DEX liquidity providing (LPing), I want to do a quick run-through of a simple LPing scenario

The way it works is that anyone who wants to provide liquidity to an exchange deposits their assets into the exchange via a “pool”

Whenever those assets are traded, the exchange charges a fee, and a fraction of that fee goes to the liquidity provider (LPer)

For example, say you deposit 10,000 USDC and 5 ETH into Uniswap, and the price of ETH is 2000 USDC

You’re depositing into the ETH/USDC pool: half the deposit (in $ value) is ETH, and half is USDC

The total value of the pool after your deposit is 100 ETH and 200,000 USDC, which means that your deposit is 5% of the pool

Now, say that the total amount of fees from Uniswap users trading ETH/USDC that day is $100

Since you own 5% of the pool, you get $5 in fees for the day

We’ll get into the issues like impermanent loss, but for now check out this impermanent loss calculator to see what it can do to LP returns.

Concentrated Liquidity:

In the days of old, when people provided liquidity to DEXs, it was used at all prices. This was an inefficient way to do things, however, because it spread the total liquidity too thin over prices that are pretty much impossible to hit (everything between 0 and infinity).

However, Uniswap changed the game with their concentrated liquidity Univ3 implementation. Now, 80% of DEX volume now comes from concentrated liquidity DEXs.

On UniV3, liquidity providers can choose the price range to provide liquidity within. When the price of the underlying asset is within any given LPer’s range, they earn a cut of Uniswap’s trade fees.

However, one of the main concerns about typical DEX LPing is that LPers are more like market takers than market makers. In other words, they are the “uninformed flow.” In UniV2, the user placing the buy/sell orders commands what price the tokens are bought and sold at. UniV3 fixes this a little bit, but the LPs still have to try and guess where the market will be at any given time; they’re still being commanded by the buyers and sellers.

If concentrated liquidity LPing is used right, a ton of volume can be handled by a small amount of liquidity. However, for the users who want to earn trading fees, it’s a pain to have to monitor your LPs and move them into “better” price ranges (e.g. the range that includes the current price of the asset).

For example, say ETH is trading at $2,000 and you have an ETH/USDC LP on Uniswap v3 that earns fees every time that pair is trading between $1,900 and $2,100. You’re earning for now, but as soon as the price moves outside that range, you have to adjust your LP; otherwise, no fees for you.

Enter the heroes: concentrated liquidity management services.

These services are amazing in many ways as we’ll see, but one thing they’re really good for is attracting liquidity into token pairs that otherwise wouldn’t see much action. This helps the assets maintain a more efficient price and also incentivizes more activity within the greater DeFi world.

For now, most liquidity goes into stable pairs and big coins like BTC and ETH, but I think we’re going to see that change over the next year or so, and definitely in the next bull market.

As you can imagine, several teams jumped on the opportunity to make this process more efficient

We’ll go over 4 of them in this article:

Arrakis Finance

Orange Finance

Gamma Strategies

Steakhut Finance

Let’s begin!

Arrakis Finance:

When it comes to LP managing services, Arrakis is the OG. It’s essentially a liquidity manager built on top of UniV3, so all of the money deposited into Arrakis gets put into Uniswap V3 LP pools.

Arrakis’ main product is still their v1 pools, which were launched back in mid-2021 when Arrakis was still known as G-UNI.

Basically, v1 created a wrapper that made UniV3 LPs fungible – the standard UniV3 LP is an ERC-721 token, which is non-fungible – this is why LPers have to withdraw and re-deposit their tokens every time they want to change their range. However, Arrakis’ wrapper converts them into ERC-20 tokens, which makes the process much easier and also saves a ton of fees.

So, Arrakis v1 users deposit their UniV3 ERC-721 tokens into their respectable vaults, Arrakis turns them into fungible ERC-20 tokens, and those LP positions are managed in a way that seeks to earn as many UniV3 trading fees as possible.

There are currently dozens of Arrakis V1 vaults live – here are some of the most popular ones:

Let’s go over a few of the traits of these vaults.

In the leftmost column, you can see which LP pool that you can deposit into as well as the chain it’s on.

For example, looking at the first vault, you have to deposit WETH and UNIDX into UniV3 on Optimism. Then, you’ll get a WETH/UNIDX LP token. That LP token can be deposited into this Arrakis vault, and Arrakis will manage it to earn lots of fees on your behalf.

Fee tier – this tells you the % that UniV3 charges users to trade each token pair. For example, it takes a 1% fee for every WETH/UNIDX trade. LPers earn a cut of that fee based on the size of their LP.

As you can see, there are also two types of fees that users can earn upon depositing their UniV3 LP tokens:

Fee APR – the annualized yield that Arrakis earns for each LP vault

Reward APR – extra incentives for Arrakis users to use specific vaults. Using WETH/UNIDX as an example again, depositors get an annualized 80.74% return in the Optimism token (OP) in addition to the Fee APR. Basically, Optimism is rewarding users who deposit their tokens into UniV3 on their blockchain.

Looking at DeFiLlama, we can see that total TVL for Arrakis stands just under $217 million. This is about 7.4% of the total Uniswap V3 TVL ($2.92 billion) – meaning Arrakis is managing 7.4% of the liquidity on UniV3.

It also turns out that those OP incentives really help! Currently, there’s $84.65 million in UniV3 TVL on Optimism, and Arrakis is handling $29.42 million of that – about 35%. Makes you wonder if we’ll soon see an $ARB incentive campaign – Arrakis is only managing about 0.5% of Arbitrum’s UniV3 TVL.

In any case, this tells me that Arrakis still has a ton of room to grow from here. There’s still over $2.7 billion of UniV3 liquidity that’s not held by Arrakis, and I think we’re going to see that change in a big way. There are two catalysts that will drive this: Arrakis V2 and the $SPICE token.

Arrakis V2:

While V2 vaults aren’t live yet, the actual V2 infrastructure is. That means that anyone with enough technical prowess can go in and create a V2 vault for themselves. But for anyone like myself, we have to wait – although, I think it will be worth it.

The premier feature of V2 is allowing multiple liquidity positions per user per vault. That means that when users deposit their LPs, they’ll be able to choose to split up their liquidity into different ranges. For example, if you deposit USDC/ETH LP tokens, you could provide 20% of ETH liquidity between 2000-5000 and 80% between 2000-3000.

This also means that liquidity can be split among different fee tiers. For commonly traded pairs like USDC/ETH, typically UniV3 charges a trading fee of 0.05%. However, if volume surges, there are “reserve” pools with higher fees that get tapped for extra liquidity. Here, you can see that USDC/ETH has 2 fee tiers: 0.05% and 0.3%. The 0.05% tier has 142% more TVL, but 1,689% more volume over the past week. So, if you think there are volatile times ahead, you could elect to put a big chunk of your USDC/ETH LP tokens into the 0.3% fee tier and earn more fees.

V2 also increases capital efficiency by putting assets to work that aren’t currently earning fees on UniV3. Keep in mind that the entirety of Arrakis’ TVL isn’t constantly in the active price range earning trading fees, which means that at any given time, there’s money just sitting there (a big no-no, especially in DeFi!). With V2 vaults, Arrakis will deploy that idle capital to earn yield on other “blue chip” protocols like Curve, Balancer, and Lido.

Private vaults are another interesting feature of V2. Of course, like V1, there will be many vaults open to the public, but V2 users will also have the option to create a custom vault for a custom list of whitelisted addresses. This would make sense for something like a DAO that wants their liquidity managed in a more efficient manner.

Users can also create their own custom strategies for vaults. In this way, V2 is more of a core piece of infrastructure for DeFi liquidity, as anyone can use it to create their own strategy. Down the road, this will benefit Arrakis as it harnesses the overall ingenuity of DeFi builders and traders, and it will potentially serve as the center of liquidity management.

This all begs the question: with Arrakis, why would anyone LP directly on Uniswap? Well, it turns out there’s a lot of demand for this service as a ton of different protocols are now using Arrakis to manage their liquidity via their newest service: PALM.

PALM:

PALM, which stands for Protocol Automated Liquidity Management, is the first service built on top of Arrakis V2. For now, it’s a B2B service provided to a growing list of DeFi protocols and DAOs to manage their liquidity.

One major hurdle for a lot of DAO treasuries out there is the fact that they’re mostly comprised of the project’s governance token. As we all saw in 2022, the downside in a bear market can be relentless for altcoins, and as a result a lot of treasuries want to improve in 2 ways:

1.) Diversify their holdings – have a bigger % allocation to ETH, BTC, stables, etc.

2.) Have better liquidity for their governance token on DEXs to help reduce slippage and volatility

PALM provides a solution to both of these actions. For each protocol, a custom vault is opened on Arrakis that manages an LP for the governance token as well as a base asset (typically ETH or a stablecoin). The best part is, the protocol can deposit any ratio of governance token/base asset. So, if they don’t have a lot of ETH, USDC, etc., they can deposit 95% of their own token and 5% ETH, or even 100% of their governance token.

The core function of PALM is to level the received token ratio out to an even 50/50. So, if Arrakis receives 100% in UNI and no ETH, they can use PALM to manage it in a way to end up with 50% of each. The way it does this is by adjusting by changing the amount of each asset that it provides to the market, and best of all, it doesn’t result in slippage or affect price impact in any way.

Clearly, there’s demand for this, as some big names are already using the service. Gelato (Arrakis’ “parent” project) and Kwenta were among the first to use it, and that list has expanded to include Fuse, Reaper, Threshold, Stader, TapiocaDAO, Perp Protocol, and many more across 6 blockchains.

Combined, those protocols have deposited over $2.2 million of assets into PALM, and have earned about $71k in fees. Not bad considering it launched less than 4 months ago and isn’t available to the public. Arrakis gets a cut of that as well: 1% of AUM and 50% of all fees earned – could be a good steady income stream for future $SPICE real yield!

SPICE:

Speaking of SPICE….when’s that token supposed to drop, anyway??

The simple answer is, nobody knows exactly when – your guess is as good as mine. However, the team has said it’s launching in 2023, and there’s reason to believe it’s “soon.”

The SPICE token has been highly anticipated for a while now. The way to qualify was by locking Gelato Network $GEL tokens (Arrakis was incubated by Gelato) between May 19th and June 10th…of 2022. Here’s the Medium article about it from over a year ago. So, people have had their $GEL locked up for a year now, and still no $SPICE.

I think it’s safe to say we can expect some solid SPICE incentives on Arrakis vaults, and it would make sense (to me, at least), to use those incentives to bootstrap liquidity into their V2 vaults once they’re released to the masses. So, we’d see the official public launch of V2, and the token would quickly follow to pay people boosted rewards for using the new vaults. Makes sense to me!

Arrakis’ Future:

Overall, Arrakis is an important and useful building block in the ever-growing tower of DeFi. If we want decentralized markets to be useful in terms of liquidity, execution, and incentives, we need LPers to be the market makers and protocol users to be the market takers. That means LPers should be able to earn steady yield while providing sufficient liquidity to users, and beyond that, all capital should be used as efficiently as possible (ideally liquid and/or earning yield at all times).

In the grand scheme of things, V2 and PALM are just a stepping stone towards Arrakis’ greater vision, which is to provide infrastructure for anyone to build on to create new and interesting ways to provide/manage liquidity in decentralized markets – and it will certainly be exciting to watch how it evolves!

Orange Finance:

Orange provides a similar service to Arrakis in that they provide UniV3 liquidity management services via vaults. However, there are some key differences which make Orange unique, which we’ll get to in just a moment.

First, let’s rehash the LPer’s biggest nightmare – impermanent loss (IL).

Any time you provide liquidity to an exchange using a token pair where at least one of the tokens is volatile, the tokens’ prices will move against each other. Since there must always be a 50/50 ratio of tokens (in UniV3, at least), LP tokens automatically buy more of the declining asset and sell some of the appreciating asset. This can obviously eat away at returns, and in many cases, it renders LPing futile.

IL is particularly troublesome for LPers who want to provide liquidity in a tight range. For example, if you deposit the USDC/ETH trading pair into UniV3 and only want to provide liquidity when ETH is between $1800-1850, you’ll generate a bigger percentage of overall trading fees when ETH is in that range than you would if you provided liquidity at an $1800-2100 ETH.

That, of course, means you earn more fees within the smaller range. However, the fact that you’re a bigger piece of overall liquidity for that range also means you get hit with more IL, which can easily outweigh the fees you earn.

Now – this is where Orange sets itself apart.

Vaults on Orange will aim to hedge against IL by using a delta-neutral strategy. What you’re left with is a pretty good combo – have your liquidity managed automatically via Orange’s contracts as efficiently as possible by always being where the money is trading, while also offsetting the downside by hedging.

However, this isn’t typical hedging – the entire point is to make money – therefore, Orange using a dynamic hedging strategy. Using different volatility metrics, the trading algo will aim to hedge when downside is likely, and allow positions to run when upside appears to be on the horizon.

Alpha Orange Vault:

Last month, Orange made their official debut on Arbitrum with their Alpha Orange Vault.

It was nice to see the community’s reception, as the $250k deposit cap was hit less than 2 weeks after its launch. More recently, the cap was raised to $350k, so we’ll see how long it takes to hit that milestone as well.

Compared to Arrakis, there are a couple clear advantages here in terms of UX. First, the process of depositing is way easier. With Arrakis, you have to first deposit your tokens into UniV3, get your LP tokens, and then deposit those LP tokens into the vault. But with Orange, you just deposit the underlying tokens directly into the vault.

More specifically, to use Alpha Orange Vault, all you need to do is deposit USDC, and Orange then deposits that USDC into the UniV3 ETH/USDC trading pair at the 0.05% fee tier.

The underlying strategy of this vault is to capture ETH upside while also taking in those nice UniV3 fees. Certain indicators such as Bollinger Bands and the 3-day ETH/USDC moving average will be used to adjust the dynamic hedge on the LP – simply put, when the indicators turn bearish, it ramps up the hedges, and it removes them when the indicators paint a more bullish picture.

It’s also worth pointing out that this strategy is semi-actively managed, although this is something the team has made clear is temporary. In the future, all Orange vaults are expected to be fully autonomous. We can think of the Alpha Orange Vault as a testing ground for future vaults – the team aims to learn from this and use it to further improve development of future products where possible.

While the live vault metrics are private, we know that this strategy had some pretty impressive backtesting results (measured from March 1, 2022 to September 1, 2022):

If the Alpha vault produces anything resembling this outperformance, we can expect a ton of attention from the greater DeFi community. But personally, I think that attention will come either way if Orange’s roadmap is any indication of the future.

Orange’s Future:

Once we get those Alpha results, Orange will be off to the races. Currently, they have 2 more vaults planned for this quarter:

· The Delta Neutral Vault, which will aim to profit during low-volatility periods by keeping a permanent delta hedge on the ETH/USDC UniV3 pair – this is achieved by borrowing against the position via Aave

· The ETH Maxi Vault, which also uses the UniV3 ETH/USDC pair, except users only deposit ETH rather than USDC

This is beneficial to ETH lovers in 2 ways:

First, it’s basically a DCA strategy on ETH – when the price goes down, you get more ETH as the pair rebalances – it can also be seen as a hedge in this regard. Second, it earns trading fees purely in ETH – gotta love that!

In Q3, the plan is to launch the Beta platform, which will increase the vault cap and allow more people to use their vaults

We can also look forward to integrations as Orange expands into LP vaults on other DEXs. We got a sneak peak at the potential here with their Honey Jar partnership, which gives them a nice entry into the Berachain ecosystem as well as the broader Cosmos IBC universe – could be big!

Q4 should bring us the official launch of Orange with their v1 platform. By that point, Orange should have several solid vaults as well as more exciting partnerships. That means different strategies for different market conditions, and lots of opportunities to earn yield.

Here’s the TL;DR:

In any case, it’ll be exciting to see what Orange does as they emerge as a contender in one of the most important areas of DeFi!

Gamma Strategies:

Like Arrakis and Orange, Gamma’s goal is to manage LP positions in a way that they’re kept concentrated at the active price of the underlying assets to earn fees, but avoid impermanent loss as much as possible. However, there are a couple key differences. First, they have a broader reach than other liquidity managers, as they manage liquidity on Uniswap, Quickswap, Zyberswap, and Thena. They also have a token, which we’ll dive deeper on shortly. These advantages definitely show up in their growth this year, as we’ll see.

The Strategies:

So, what type of strategies does Gamma use?

For now, there are four different strategies employed by Gamma. First, we have the narrow range and wide range strategies. Both of these are dynamic strategies, meaning the pool funds are rebalanced and moved into different price ranges when necessary. The other two are the stable strategy and the pegged asset strategy, which are used for stables/pegged assets and are static rather than dynamic.

As the name suggests, the narrow range strategy keeps liquidity in tight ranges with the goal of earning higher fees (remember, when you have a tight range, your funds are a higher % of that range, which means more fees go to you). The risk is that higher trading means more asset turnover, which means higher IL as well as higher swap fees to rebalance. Generally, the narrow range strategy is better for short-term positions with low volatility.

The wide range strategy is also self-explanatory, in that it holds liquidity in wider price ranges. This is a less risky strategy, as a wider range doesn’t have as much turnover or IL. However, since a wider range means you take up less “real estate” in the overall liquidity landscape, you won’t earn as many fees. This strategy is better suited for low-risk, long-term yield and is expected to outperform the narrow range strategy overall.

Finally, the stable and pegged price strategies seek to earn fees by providing liquidity around the price of stablecoins and other pegged assets like LSDs. For stablecoins, the less “risky” the coin, the tighter the range. For example, it might provide liquidity for the USDC/USDT pair when it trades between 1.001 and 0.999. But for something like USDC/MIM, it could expand that range to between 1.01 and 0.99. As for LSDs, it will provide liquidity for something like stETH at a fixed range that straddles the ETH price.

As I mentioned earlier, the key difference with the stable and pegged asset strategies is that they’re static, meaning there’s no rebalancing. This saves on fees, but it also means that if the asset goes outside the range, it also won’t earn any trading fees. This is a decent tradeoff, as rebalancing and potential IL from LPing de-pegged assets could get pretty ugly.

Gamma provides these strategies in two “tiers.” The first is their Gamma Automated products, which are public in their dapp. They also have a Gamma Enterprise tier which is dedicated to help specific protocols/DAOs manage their liquidity. The Enterprise pools are private and whitelisted, and can use customized versions of the three strategies listed above, depending on the partner’s objectives.

Gamma Ecosystem:

Gamma is currently live on 7 chains and 4 different DEXs:

UniV3 – Ethereum, Arbitrum, Optimism, Polygon PoS chain, Celo

QuickswapV3 – Polygon PoS chain, Polygon zkEVM

ZyberSwap – Arbitrum

Thena – BNB Chain

Overall, Gamma Strategies has about $100 million in TVL, with Polygon and BNB chain accounting for about 70% of that total. Most of the Polygon TVL is on Quickswap, which is the top DEX on Polygon in terms of TVL.

You can also see that the TVL has increased considerably over the past few months. Breaking the TVL down by chain, we can see that the biggest causes of this have been parabolic moves in Polygon (purple) and BNB chain (blue):

Back in late January, Gamma had the advantage of being the first liquidity manager for QuickswapV3 LPs, and so money poured in on Polygon. Of course, the $dQUICK and $WMATIC bonus rewards on their Quickswap vaults helped onboard new users as well.

Less than 3 months later, Gamma pools were live on Thena, which has been a rapidly growing part of the BNB chain DeFi ecosystem:

https://twitter.com/ThenaFi_/status/1648794675959025664

Currently, Gamma is carving out a nice market for themselves on Quickswap and Thena. They currently manage over 61% of QuickswapV3’s TVL and 48% of Thena’s TVL. Basically, these markets are theirs to lose!

As you might expect, the pools on Polygon and BNB chain have some pretty great incentives. The QuickswapV3 pools, for example are paying out thousands of dollars per day to depositors. Take a look at these massive rewards in the right hand column:

And rewards on Thena pools are no joke either!

Lastly, Gamma’s Optimism vaults have been crushing it as well as the $OP rewards keep flowing strong. In fact, Gamma is currently in phase 3 of their $OP rewards program – altogether, the 3 phases have paid/are paying out 300,500 $OP tokens to UniV3 Gamma depositors on Optimism

$GAMMA:

One feature of Gamma that hasn’t been present (yet) in the previous two protocols is a token: let’s talk about $GAMMA

Gamma takes a varying portion of the fees from each pool, which is typically 10% but in some cases that number will vary. Those fees are then redistributed to GAMMA stakers, typically on a daily basis.

When you stake GAMMA, you receive xGAMMA in return. The xGAMMA price includes the fees that it accrues, so it’s worth more than the underlying GAMMA.

It’s also important to note that GAMMA stakers don’t receive xGAMMA at a 1:1 ratio, and the price of xGAMMA is denominated in GAMMA. What does this mean? Let’s run through an example.

Stake 1,000 GAMMA

xGAMMA price = 1.1 GAMMA

Receive 909 xGAMMA (1000/1.1)

While staked, your xGAMMA accrues fees and is now worth 1.3 GAMMA

Exchange your 909 xGAMMA at a price of 1.3 GAMMA

Receive 1,182 GAMMA

Your profit is 182 GAMMA despite having a steady 909 xGAMMA the whole time

While this method may be a little more complex that most, it eliminates the need to pay gas fees every time you want to claim your rewards. Instead, those rewards are automatically built into the xGAMMA token’s price. Finally, xGAMMA isn’t tradable at this point since there are no DEX liquidity pools that support it, although this may change in the future.

Speaking of the future, let’s take a look at what Gamma is working on! (side note: this is a very heads-down team which I consider bullish, but when they do make an appearance on Twitter Spaces, etc., it’s worth listening to)

Gamma’s Future:

A lot of the work behinds the scenes seems to be on expanding the variety and scope of liquidity management strategies. Specifically, the focus is on delta neutral vaults on top of LP pools.

One idea in the works is a leveraged strategy: use the LP tokens as collateral to borrow more of each underlying token, deposit them into the LP, and repeat. For example, if you’re providing liquidity on the ETH/WBTC pair, you’d post the ETH/WBTC LP tokens as collateral, borrow ETH and BTC against it, and deposit them into the vault.

Another delta-neutral strategy would be to collateralize stablecoins and borrow ETH against them. In this case, if ETH goes up, you’re capturing that upside via LP in the pool. If ETH goes down, you benefit from the ETH loan since you’ll owe less in stables to pay it off.

Overall, fees + rewards – borrowing costs = delta-neutral yield.

The team has also mentioned more “risk-on” vaults, which would use perps to boost depositors’ yield in addition to the LP earnings. It sounds like this strategy wouldn’t be a hedge, but the opposite: it’d magnify the return in either direction. Higher risk, higher reward.

Steakhut Finance:

Another unique player in the concentrated liquidity game is Steakhut Finance. This project actually started out by boosting rewards on Trader Joe’s JOE token, with the aim of becoming to Trader Joe what Convex is to Curve. However, they’ve since evolved to being the primary manager of liquidity on JoeV2. Right off the bat, this sets Steakhut apart from Arrakis, Orange, and Gamma. But that’s only the beginning!

Without going into too much detail, JoeV2 is actually an improvement on the UniV3 model as it allows LPers to have more flexibility in how they provide and distribute liquidity. A recent update to JoeV2, called V2.1, actually enables automated strategies for LPers called Autopools as well.

As you read about Steakhut in this article, you may see how Autopools could be a competitor to Steakhut. It’s certainly a respectable stance, but as we get into some of the developments that Steakhut has recently made, you’ll see that they’re setting themselves apart and incentivizing the use of their platform through some pretty awesome products.

Also, JoeV2 is just the beginning. Steakhut’s ultimate goal is to manage liquidity across all major exchanges and DEXs and become the liquidity layer of DeFi.

Overview:

By now, you probably know the genera idea of how this stuff works. On Steakhut, you deposit tokens into various JoeV2 pools, and then they manage it to optimize your rewards.

One nice feature of Steakhut pools is that when a user deposits liquidity into them, they receive an ERC-20 wrapped version of the JoeV2 LP token. This seems similar to the Arrakis method of converting UniV3 LP tokens. Originally, JoeV2 LP tokens are ERC-1155, which is also different from UniV3’s ERC-721. However, both of them are similar in that you can’t do much with them, so converting either one into an ERC-20 gives it a lot more utility, so you can then go and use those Steakhut LP tokens elsewhere (spoiler alert: you can use them on Steakhut – we’ll come back to that later).

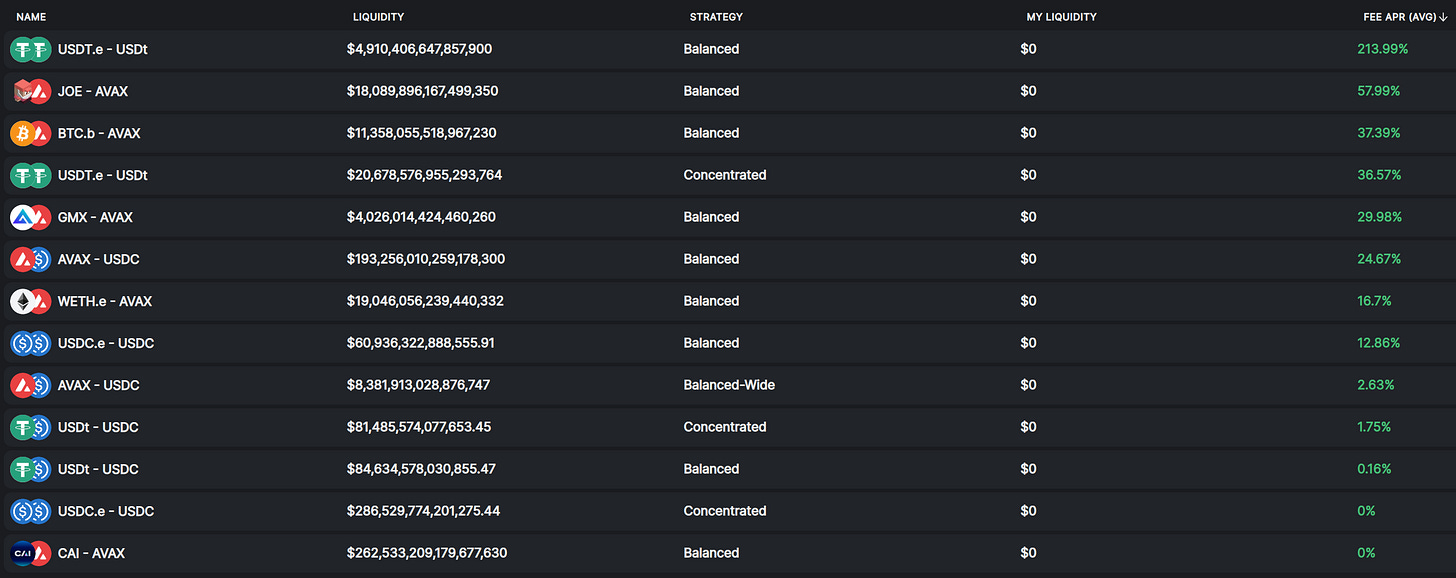

Currently, Steakhut is live on 2 chains: Avalanche and Arbitrum. As you can see below, they’ve got a solid selection of pools on both. Here’s their Avalanche selection:

And their Arbitrum selection:

The astute observer will see that there are two types of strategies in those pools: balanced and concentrated (with one labeled Balanced-Wide). Here’s what they mean:

Balanced – liquidity is spread out relatively widely, meaning you earn fees on a wider price range of the underlying asset

Concentrated – liquidity is kept in a tight range

For now, concentrated strategies are only available for stablecoin pairs (USDC/USDT, etc.), as they tend to generate higher IL albeit higher fees for volatile pairs. However, Steakhut has been working on concentrated strategies for volatile pairs, so we should see those be available in due time.

While balanced strategies are typically used on volatile pairs, you may have noticed that there are some stable pairs on Steakhut that also use this option. This makes sense for relatively illiquid stablecoins that may experience volatility such as USDC.e or USDT.e. However, for the more liquid stablecoins, a concentrated will probably outperform more often than not. For example, in the screenshot above, the concentrated USDT/USDC pool is yielding 1.75% while the balanced pool is only earning 0.16%.

In return for managing liquidity, Steakhut takes a cut of the overall fees earned by the users:

5% of total fees on stable and pegged pairs (stablecoins, LSDs, etc.)

10-15% on non-stable pairs

10-20% on custom strategies

Similar to Arrakis and Gamma, Steakhut is aware of the demand to manage liquidity for protocol DAOs and other organizations/institutions. This leads us to their professional service, Liquidity as a Service (LaaS). With LaaS, protocols can take advantage of additional features such as private vaults, custom-managed liquidity and incentive management for their LPs. Some of their partners so far include Buffer Finance, Colony Labs, Phuture Finance, and Unidex.

Boosted Rewards:

This is where that handy ERC-20 wrapper comes into play!

Steakhut has a nice feature called Concentrated Reward Farms, which is where users can earn boosted rewards in addition to Steakhut’s LP strategies. Here’s a step-by-step look at how it works, using the AVAX/USDC pool:

(steakhut3)

(That TVL tho, lmao)

Deposit USDC and AVAX into Steakhut AVAX/USDC pool

Get an ERC-20 token representing your share in Steakhut AVAX/USDC pool

Earn 24.67% (as pictured above)

Deposit the ERC-20 token into the AVAX/USDC reward farm, which is on the bottom right

Earn an additional 5.3% in STEAK and JOE tokens (Steakhut Boost)

In addition to paying more yield to users, the reward farms incentivize protocols to provide concentrated liquidity in certain ranges. The protocols can then offer users their native token (the boosted reward) in addition to JOE and STEAK which appear to be the standard bonuses on Steakhut.

Ultimately, when you deposit the ERC-20 wrapped LP tokens, Steakhut puts them into specific price ranges that help create more efficient markets on JoeV2. As you can imagine, this is a win-win for protocols that need the liquidity, especially for smaller/newer projects.

The users win because they get extra rewards in STEAK, JOE, and most likely the LP project’s native token as well.

The projects win because Steakhut manages their liquidity more efficiently and they don’t have to pay a ton of emissions to get the benefit of added liquidity. They can add their own emissions if they want (my guess is most if not all will do this on some level), but the Steakhut depositors already get rewards in STEAK and JOE, so there’s not as much pressure on the protocol that really just wants liquidity. Overall, it keeps at least some mercenary capital away and curbs the need for emissions/inflation.

Steaking 2.0:

The most recent development from the land of Steakhut is Steaking 2.0, which unlocks lots of rewards for $STEAK steakers.

With Steaking 1.0, users earned real yield from the protocol, but it was just in the form of fees from their v1 pools. After the launch of the v2 pools (which is what this article has focused on), the v1 pools were basically rendered obsolete and the liquidity (and therefore the fees) dried up.

But now, a revitalized group of steakers emerges stronger, as Steaking 2.0 pulls rewards from all pools, vaults, and any future products, right into the hands of STEAK steakers.

Here’s how it works:

Deposit your STEAK and receive xSTEAK

Deposit xSTEAK in the “Rewards” tab

Earn real yield in the form of USDC and xSTEAK

There’s also some extra incentive to keep your STEAK locked up. To begin with, you won’t be able to withdraw it at all until 15 days after you locked it. But if you withdraw between day 15 and day 90, you only get back 0.5 STEAK for every xSTEAK that you have. After 90 days, you’ll get back the STEAK at a normal 1:1 ratio.

One interesting feature with Steaking 2.0 is that rewards can be paid out in multiple token types. Currently, the rewards are all paid out in xSTEAK and USDC, but it wouldn’t surprise me to see some JOE rewards mixed in at some point, too. This also means the STEAK token itself could be a beneficiary of the growth within DeFi. As Steakhut becomes more prominent, more projects will want to bribe users to manage their liquidity, and they may even be willing to pay xSTEAK holders directly.

Steakhut’s Future:

Steaking 2.0 is just one of the many exciting things that Steakhut has on its roadmap for 2023. A couple more catalysts over the coming months include permissionless vaults, Strategy Marketplace, and expansion onto new chains.

Permissionless Vaults:

Now that Steakhut is becoming an established DeFi liquidity manager, the team is getting ready to hand control over to the users by allowing permissionless vaults. This means that anyone will be able to open a liquidity managing pool using their own management strategy. This will be attractive for individuals and other protocols alike, and it opens the door for more capital efficiency on JoeV2.

Strategy Marketplace:

This will be a new section on Steakhut’s dapp that will include Steakhut’s permissioned/whitelisted strategies up front as well as custom-made permissionless strategies

Up front, users will be able to see Steakhut’s featured strategies, but there will also be a section to see public vault strategies created by other users. Vault creators will be incentivized to create the best possible strategy as they’ll earn performance-related fees. Of course, a portion of those fees will also go to xSTEAK holders. Everyone benefits from this:

The protocol gets more liquidity as people flock to the top performing strategies,

The strategy creators benefit by earning fees

Steakers benefit from getting a cut of those fees as well

Overall, Strategy Marketplace brings an element of social trading (another narrative I’m bullish on) to the liquidity management side of DeFi.

Chain expansion:

Trader Joe and Steakhut are aligned in their vision to becoming multi-chain winners, and so both of them have converted their tokens from ERC-20s to OFT-20s. An OFT-20 is LayerZero’s Omnichain Fungible Token standard, and can be used across any LayerZero-compatible chain (of which there are many). With JoeV2’s recent expansion to BNB chain, I think it’s fair to say Steakhut will make that their next destination as well. The sky is the limit!

Stay Tuned:

If you made it this far, congrats! I hope you enjoyed part 1, and I hope you learned something useful. I’d love to hear any thoughts, questions, corrections, etc. in the comments below. Stay tuned for part 2!