Hey, anon

Do you want DeFi to actually go mainstream?

Or do you want to keep feeling like CT is the real world?

If you answered yes to the first question, I’ve got 2 projects that you should care about

This thread will dive into #1 -- @carbondefixyz

I’ll just come out and say it – institutions probably look at DEX capital efficiency and laugh

Why?

Here are a couple simple reasons

✅ LPers aren’t market makers in their current state

✅ IL….yea that pretty much says it all. IL needs to go.

Bringing in pros to make markets in DeFi will give way more credibility to the space

Carbon allows LPs to actually be MMs

It also gets rid of IL

So, what is Carbon?

It’s a new trading protocol From @Bancor, which actually created the first AMM – in other words, they’ve been around the block

It’s unlike anything I’ve ever seen in DeFi, and that’s a good thing

Here are some key features we’ll go over:

1️⃣ Asymmetric Liquidity

2️⃣ Say Bye To IL

3️⃣ Strategy Backtests

4️⃣ Carbon’s Future

1️⃣ Asymmetric Liquidity

Carbon isn’t an AMM or orderbook – it’s a giant matching system that uses DEX aggregators, arbitrageurs, and the Carbon interface itself

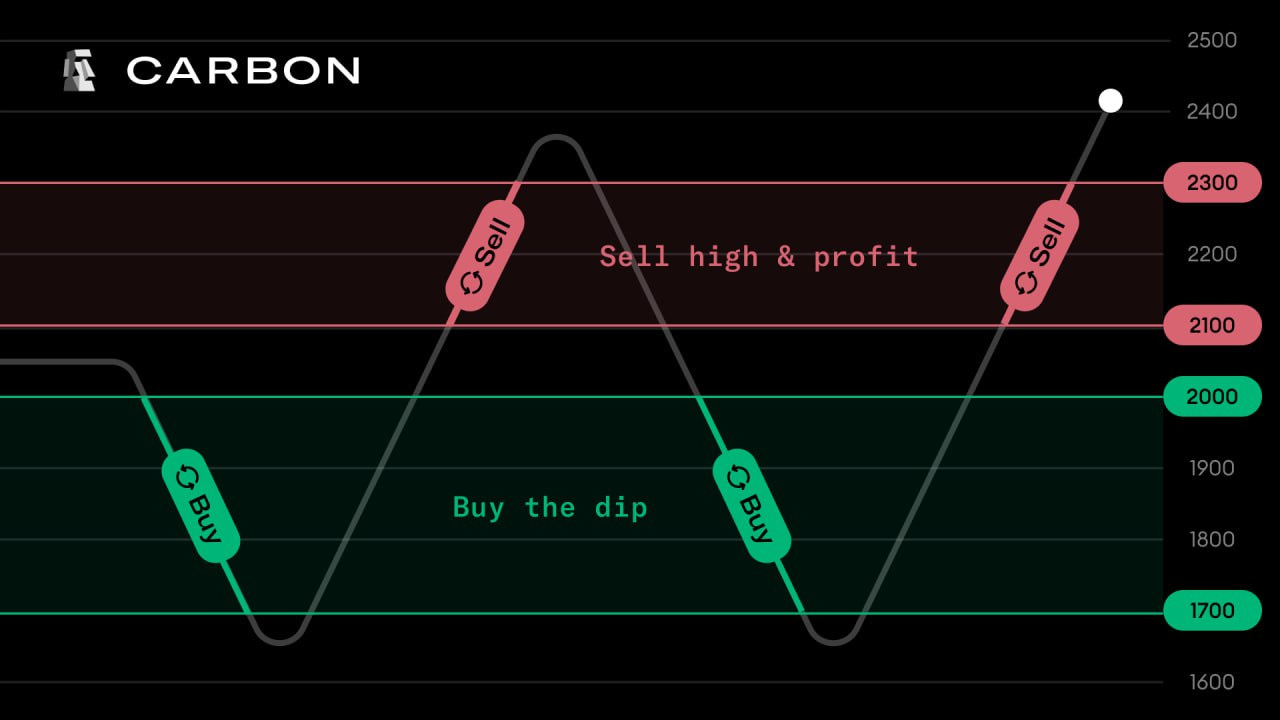

Say you want to provide liquidity for the ETH/USDC pair -- just enter the prices where you want to buy/sell ETH for USDC

For example, you can create a strategy to buy ETH at 1300-1400 USDC and sell at 1900-2000 USDC

It's basically a set of limit orders – buy low, sell high

But here’s the difference between Carbon and other DEXs – each one of those limit orders is on its own “curve” – buy low and sell high

That means once you’ve bought the dip, orders on the “buy low” curve no longer fill – you won’t sell until the price hits your “sell high” curve

On a traditional DEX like UniV3, if the price breaks above your range, and goes back down into it, you sell at the low prices

That means you buy high/sell high and buy low/sell low

And voila – the magic of asymmetric curves!

2️⃣ Say Bye To IL

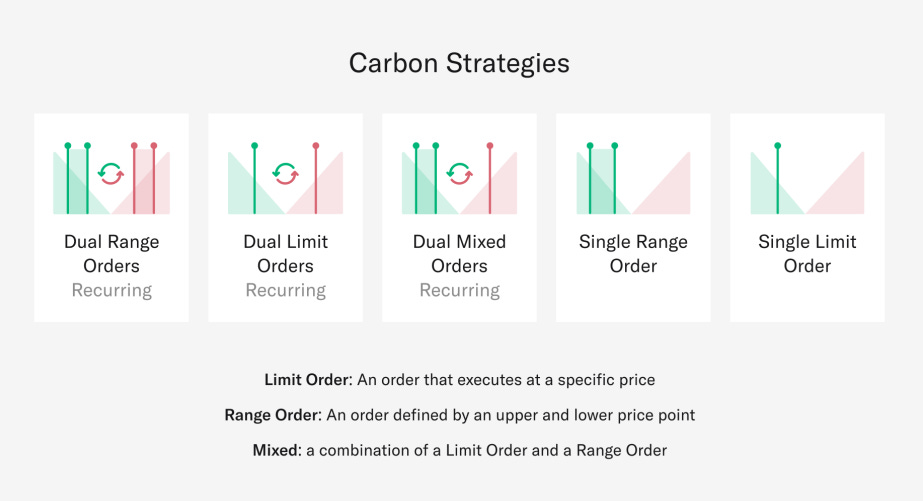

You can think of Carbon as an interface to set various strategies using limit/range orders

As a result, there’s no rebalancing of tokens when an order is filled – nor is there the need to keep the token pair ratio at 50:50

Since rebalancing is the source of IL, no rebalancing = no IL

No IL also means there’s less urgency for “LPers” to earn trading fees

Instead, execution is what matters – LPers make their money from the bid/ask spread, like “real” market makers

That means all fees can be passed through to the protocol

For now, that's up to the governance of the BNT (Bancor token) holders 2 quick thoughts on that:

🤔I think we’ll see this become an incredible source of real yield at some point

🤔This implies a Carbon native token

3️⃣ Strategy Backtests

If you’re still following me, well done!

You may be thinking – this all sounds good in theory, but can it actually outperform the market?

I’m here to tell you – yes, yes it can

The most obvious example of when Carbon comes in handy is in a rangebound (see: “crab”) market

That’s when buy low/sell high/repeat really shines

Let’s see what happened earlier this year when you used the following criteria:

✅ Buy ETH with USDC when ETH price is between 1000-1250 USDC (buy low)

✅ Sell ETH for USDC when ETH price is between 1500-2000 USDC (sell high)

✅ Start with 750 USDC and 1 ETH worth of liquidity

Here’s how it turned out ETH price went from 1500 to 1100

Portfolio value went from 1300 to 3000

ETH return = -27%

Portfolio return = 131%

Not bad for a simple range strategy!

There are plenty more examples like this

Here’s one that shows how a Carbon strategy annihilated similar strategies on UniV2 and V3:

Jen 🗿@Here2DeFi・05/19/2023

Backtested my 1 year $ETH / $USDC trading strategy: Constant Product: +1.27% Concentrated Liquidity: +9.12% (~7.18x Uni V2) @carbondefixyz's Asymmetric Liquidity: +76.50% (~60.24x Uni V2 & ~8.39x Uni V3) 🗿 📈📉 For more details, read my latest blog:

4️⃣ Carbon’s Future

There’s a lot to look forward to here, as Carbon is one of the most interesting projects I’ve come across in DeFi

Here’s a couple thoughts on the future

✅ Scale DEX aggregator and arbitrage bot

In order to have efficient pricing, scaling these two things is a must

The team is currently in talks with 1inch, and their arb bot uses UniV2/V3, Sushi, and BancorV3 to get price info

✅ Wen token? Wen yield?

Right now, protocol fees are used to buy/burn BNT tokens, and BNT holders conduct Carbon governance

Once the BNT deficit in BancorV2.1 and V3 reaches parity, there could be a vote to handle the fees in a different manner (give to users!)

I see a Carbon native token being the ultimate solution here

Thanks for reading! I hope you enjoyed my thread

For a deeper look into @carbondefixyz, check out my article here: